UPS 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

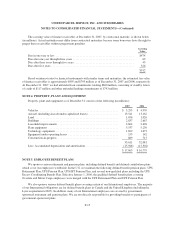

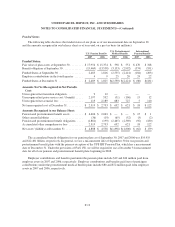

Amortization of intangible assets was $236, $255, and $255 million during 2007, 2006 and 2005, respectively.

Expected amortization of finite-lived intangible assets recorded as of December 31, 2007 for the next five years is

as follows (in millions): 2008—$167; 2009—$109; 2010—$67; 2011—$23; 2012—$20. Amortization expense in

future periods will be affected by business acquisitions, software development, and other factors.

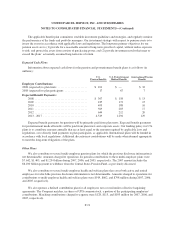

NOTE 7. BUSINESS ACQUISITIONS AND DISPOSITIONS

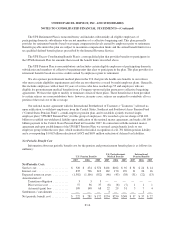

In December 2004, we agreed with Sinotrans Air Transportation Development Co., Ltd. (“Sinotrans”) to

acquire direct control of the international express operations in 23 cities within China, and to purchase

Sintotrans’ interest in our current joint venture in China. As of December 31, 2006, we had made all cash

payments under the purchase agreement, a total of $114 million, and had taken direct control of operations in all

23 locations. The operations acquired are reported within our International Package reporting segment.

In May 2005, we acquired Messenger Service Stolica S.A. (“Stolica”), one of the leading parcel and express

delivery companies in Poland. Stolica’s operating results are included in our International Package reporting segment.

In August 2005, we acquired Overnite Corporation (“Overnite”) for approximately $1.225 billion in cash.

Overnite offers a variety of LTL and TL services to more than 60,000 customers in North America. The

operating results of Overnite, which is now known as UPS Freight, are included in our Supply Chain & Freight

reporting segment.

In September 2005, we acquired Lynx Express Ltd. (“Lynx”) for approximately $68 million in cash. Lynx

Express was one of the largest independent parcel carriers in the United Kingdom. Lynx also offers customers a

broad suite of logistics and spare parts logistics services. The operating results of Lynx are included in our

International Package reporting segment.

Pro forma results of operations have not been presented for any of these acquisitions because the effects of

these transactions were not material on either an individual or aggregate basis. The results of operations of each

acquired company are included in our statements of consolidated income from the date of acquisition. The

purchase price allocations of acquired companies can be modified up to one year after the date of acquisition.

NOTE 8. DEBT OBLIGATIONS AND COMMITMENTS

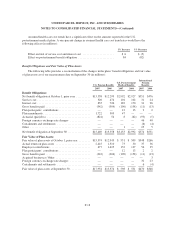

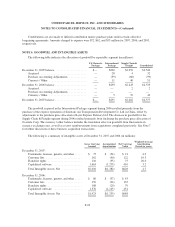

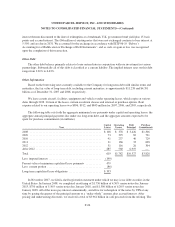

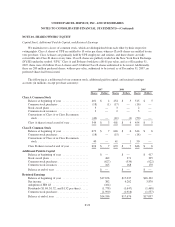

Debt obligations, as of December 31, consist of the following (in millions):

2007 2006

8.38% debentures .................................................. $ 761 $ 731

Commercial paper .................................................. 7,366 791

Floating rate senior notes ............................................ 441 441

Capital lease obligations ............................................. 479 230

Facility notes and bonds ............................................. 435 437

UPS Notes ........................................................ 513 379

Pound Sterling notes ................................................ 989 979

Other debt ........................................................ 34 128

Total debt ......................................................... 11,018 4,116

Less current maturities .............................................. (3,512) (983)

Long-term debt .................................................... $ 7,506 $3,133

F-23