UPS 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

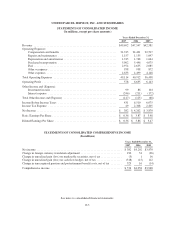

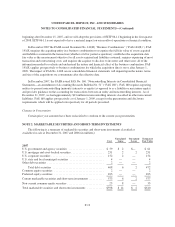

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

STATEMENTS OF CONSOLIDATED CASH FLOWS

(In millions)

Years Ended December 31,

2007 2006 2005

Cash Flows From Operating Activities:

Net income ........................................................ $ 382 $4,202 $ 3,870

Adjustments to reconcile net income to net cash from operating activities:

Depreciation and amortization ................................ 1,745 1,748 1,644

Pension and postretirement benefit expense ...................... 513 568 442

Pension and postretirement benefit contributions .................. (687) (1,625) (995)

Deferred taxes, credits and other ............................... (249) 99 189

Stock compensation expense .................................. 447 369 234

Self-insurance reserves ...................................... 69 180 261

Asset impairment and obsolescence charge ...................... 221 — —

Other (gains) losses ......................................... 243 128 170

Changes in assets and liabilities, net of effect of acquisitions:

Accounts receivable ..................................... (380) (77) (789)

Income taxes receivable ................................. (1,191) 17 440

Other current assets ..................................... (3) 82 (160)

Accounts payable ....................................... (37) 24 158

Accrued wages and withholdings .......................... 108 12 56

Other current liabilities .................................. 56 (120) 273

Other operating activities .................................... (114) (18) —

Net cash from operating activities .................................. 1,123 5,589 5,793

Cash Flows From Investing Activities:

Capital expenditures ................................................ (2,820) (3,085) (2,187)

Proceeds from disposals of property, plant and equipment ................... 85 75 27

Purchases of marketable securities and short-term investments ............... (9,017) (9,056) (7,623)

Sales and maturities of marketable securities and short-term investments ....... 9,638 9,538 10,375

Net (increase) decrease in finance receivables ............................ (39) 68 95

Cash paid for business acquisitions ..................................... (2) (50) (1,488)

Other investing activities ............................................. (44) 170 (174)

Net cash (used in) investing activities ............................... (2,199) (2,340) (975)

Cash Flows From Financing Activities:

Net change in short-term debt ......................................... 2,613 (513) (287)

Proceeds from long-term borrowings ................................... 4,094 649 128

Repayments of long-term borrowings ................................... (198) (90) (302)

Purchases of common stock .......................................... (2,639) (2,460) (2,479)

Issuances of common stock ........................................... 174 164 164

Dividends ......................................................... (1,703) (1,577) (1,391)

Other financing activities ............................................ (44) (24) (8)

Net cash provided by (used in) financing activities .................... 2,297 (3,851) (4,175)

Effect Of Exchange Rate Changes On Cash And Cash Equivalents ............ 12 27 (13)

Net Increase (Decrease) In Cash And Cash Equivalents ...................... 1,233 (575) 630

Cash And Cash Equivalents:

Beginning of period ................................................. 794 1,369 739

End of period ...................................................... $2,027 $ 794 $ 1,369

Cash Paid During The Period For:

Interest (net of amount capitalized) ..................................... $ 248 $ 210 $ 169

Income taxes ...................................................... $1,351 $ 2,061 $ 1,465

See notes to consolidated financial statements.

F-6