UPS 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

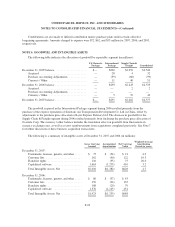

Contributions are also made to defined contribution money purchase plans under certain collective

bargaining agreements. Amounts charged to expense were $72, $62, and $55 million for 2007, 2006, and 2005,

respectively.

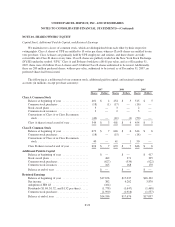

NOTE 6. GOODWILL AND INTANGIBLE ASSETS

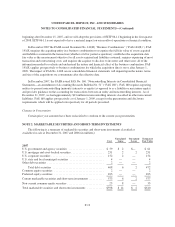

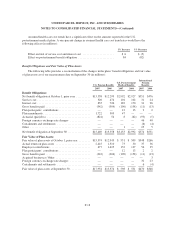

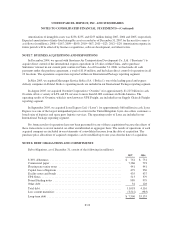

The following table indicates the allocation of goodwill by reportable segment (in millions):

U.S. Domestic

Package

International

Package

Supply Chain &

Freight Consolidated

December 31, 2005 balance ...................... $— $290 $2,259 $2,549

Acquired ................................. — 28 4 32

Purchase Accounting Adjustments ............ — (39) (60) (99)

Currency / Other .......................... — 11 40 51

December 31, 2006 balance ...................... — $290 $2,243 $2,533

Acquired ................................. — — 2 2

Purchase Accounting Adjustments ............ — — — —

Currency / Other .......................... — 5 37 42

December 31, 2007 balance ...................... $— $295 $2,282 $2,577

The goodwill acquired in the International Package segment during 2006 resulted primarily from the

purchase of the express operations of Sinotrans Air Transportation Development Co. Ltd. in China, offset by

adjustments to the purchase price allocation of Lynx Express Delivery Ltd. The decrease in goodwill for the

Supply Chain & Freight segment during 2006 resulted primarily from finalizing the purchase price allocation of

Overnite Corp. The currency / other balance includes the translation effect on goodwill from fluctuations in

currency exchange rates, as well as escrow reimbursements from acquisitions completed previously. See Note 7

for further discussion of these business acquisition transactions.

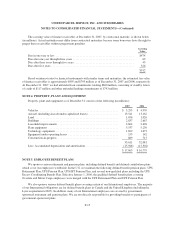

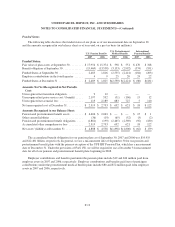

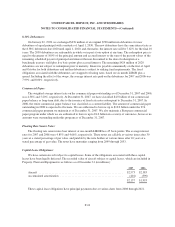

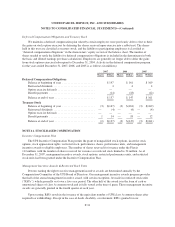

The following is a summary of intangible assets at December 31, 2007 and 2006 (in millions):

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Value

Weighted-Average

Amortization

Period (in years)

December 31, 2007:

Trademarks, licenses, patents, and other ..... $ 75 $ (54) $ 21 4.2

Customer lists ......................... 162 (40) 122 10.5

Franchise rights ........................ 110 (35) 75 20.0

Capitalized software .................... 1,663 (1,253) 410 3.2

Total Intangible Assets, Net .............. $2,010 $(1,382) $628 4.7

December 31, 2006:

Trademarks, licenses, patents, and other ..... $ 80 $ (37) $ 43

Customer lists ......................... 159 (24) 135

Franchise rights ........................ 108 (29) 79

Capitalized software .................... 1,576 (1,145) 431

Total Intangible Assets, Net .............. $1,923 $(1,235) $688

F-22