UPS 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

providing a revolving credit facility of $7.0 billion and expiring on October 17, 2008. Interest on any amounts we

borrow under these facilities would be charged at 90-day LIBOR plus 15 basis points. At December 31, 2007,

there were no outstanding borrowings under these facilities.

Our existing debt instruments and credit facilities do not have cross-default or ratings triggers, however

these debt instruments and credit facilities do subject us to certain financial covenants. Covenants in our credit

facilities generally require us to maintain a $3.0 billion minimum net worth and limit the amount of secured

indebtedness that may be incurred by the company. The notes issued in January 2008 include limitations on

secured indebtedness and on sale-leaseback transactions. These covenants are not considered material to the

overall financial condition of the company, and all applicable covenant tests were satisfied as of December 31,

2007.

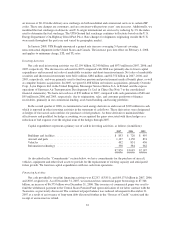

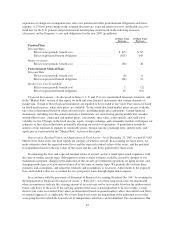

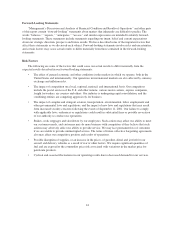

Commitments

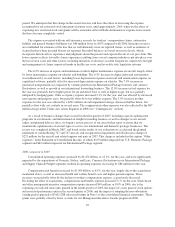

We have contractual obligations and commitments in the form of capital leases, operating leases, debt

obligations, purchase commitments, and certain other liabilities. We intend to satisfy these obligations through

the use of cash flow from operations. The following table summarizes the expected cash outflow to satisfy our

contractual obligations and commitments as of December 31, 2007 (in millions):

Year

Capital

Leases

Operating

Leases

Debt

Principal

Debt

Interest

Purchase

Commitments

Pension

Fundings

Other

Liabilities

2008 .......................... $108 $ 378 $ 3,426 $ 329 $1,306 $ 101 $ 78

2009 .......................... 73 325 83 384 791 824 74

2010 .......................... 91 237 40 380 729 630 71

2011 .......................... 31 166 33 379 698 717 69

2012 .......................... 31 116 26 377 304 859 67

After 2012 ..................... 285 560 6,919 6,177 — 334 203

Total .......................... $619 $1,782 $10,527 $8,026 $3,828 $3,465 $562

Our capital lease obligations relate primarily to leases on aircraft. Capital leases, operating leases, and

purchase commitments, as well as our debt principal obligations, are discussed further in Note 8 to our

consolidated financial statements. The amount of interest on our debt was calculated as the contractual interest

payments due on our fixed-rate debt, in addition to interest on variable rate debt that was calculated based on

interest rates as of December 31, 2007. The calculations of debt interest do not take into account the effect of

interest rate swap agreements. The maturities of debt principal and interest include the effect of the January 2008

issuance of $4.0 billion in senior notes that were used to reduce the commercial paper balance.

Purchase commitments represent contractual agreements to purchase goods or services that are legally

binding, the largest of which are orders for aircraft, engines, and parts. In February 2007, we announced an order

for 27 Boeing 767-300ER freighters to be delivered between 2009 and 2012. We also have firm commitments to

purchase nine Boeing 747-400F aircraft scheduled for delivery between 2008 and 2010, and two Boeing

747-400BCF aircraft scheduled for delivery during 2008. These aircraft purchase orders will provide for the

replacement of existing capacity and anticipated future growth.

In July 2007, we formally cancelled our previous order for ten Airbus A380-800 freighter aircraft, pursuant

to the provisions of an agreement signed with Airbus in February 2007. As a result of our cancellation of the

Airbus A380-800 order, we received cash in July 2007 representing the return of amounts previously paid to

Airbus as purchase contract deposits and accrued interest on those balances. Additionally, we received a credit

memorandum to be used by UPS for the purchase of parts and services from Airbus. The cancellation of the

Airbus order did not have a material impact on our financial condition, results of operations, or liquidity.

34