UPS 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

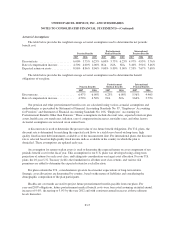

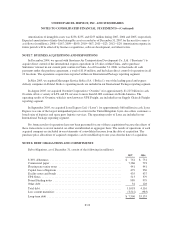

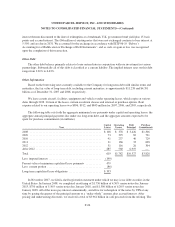

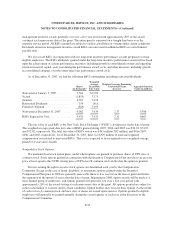

proceeds from the offering were used to reduce our outstanding commercial paper balance. The annual principal

payments due under our debt obligations in the table above reflect the January 2008 issuance of long-term debt

and refunding of commercial paper.

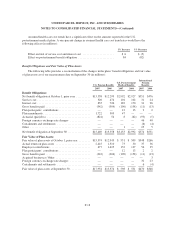

As of December 31, 2007, we had outstanding letters of credit totaling approximately $2.177 billion issued

in connection with routine business requirements.

We maintain three credit agreements with a consortium of banks, two of which provide revolving credit

facilities of $1.0 billion each, with one expiring April 17, 2008 and the other April 19, 2012, and the third

providing a revolving credit facility of $7.0 billion and expiring on October 17, 2008. Interest on any amounts we

borrow under these facilities would be charged at 90-day LIBOR plus 15 basis points. At December 31, 2007,

there were no outstanding borrowings under these facilities.

Our existing debt instruments and credit facilities do not have cross-default or ratings triggers, however

these debt instruments and credit facilities do subject us to certain financial covenants. These covenants generally

require us to maintain a $3.0 billion minimum net worth and limit the amount of secured indebtedness available

to the company. These covenants are not considered material to the overall financial condition of the company,

and all covenant tests were passed as of December 31, 2007.

NOTE 9. LEGAL PROCEEDINGS AND CONTINGENCIES

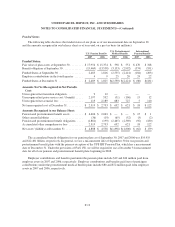

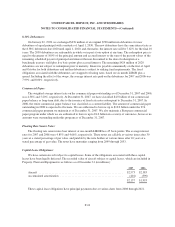

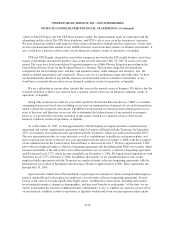

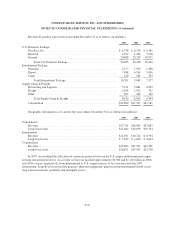

We are a defendant in a number of lawsuits filed in state and federal courts containing various class-action

allegations under state wage-and-hour laws. In one of these cases, Marlo v. UPS, which has been certified as a

class action in a California federal court, plaintiffs allege that they improperly were denied overtime, and seek

penalties for missed meal and rest periods, and interest and attorneys’ fees. Plaintiffs purport to represent a class of

1,200 full-time supervisors. In August 2005, the court granted summary judgment in favor of UPS on all claims,

and plaintiff appealed the ruling. In October 2007, the appeals court reversed the lower court’s ruling. We have

denied any liability with respect to these claims and intend to vigorously defend ourselves in this case. At this

time, we have not determined the amount of any liability that may result from this matter or whether such liability,

if any, would have a material adverse effect on our financial condition, results of operations, or liquidity.

In another case, Cornn v. UPS, which was certified as a class action in a California federal court, plaintiffs

allege that they were improperly denied wages and/or overtime and meal and rest periods. Plaintiffs purport to

represent a class of approximately 23,600 drivers and seek back wages, penalties, interest and attorneys’ fees.

UPS settled this matter in full for a total payment of $87 million in the second quarter of 2007. The settlement

had no impact on our 2007 operating results as it was accrued for previously during the third quarter of 2006.

In another case, Hohider v. UPS, which in July 2007 was certified as a class action in a Pennsylvania federal

court, plaintiffs have challenged certain aspects of the Company’s interactive process for assessing requests for

reasonable accommodation under the Americans with Disabilities Act. Plaintiffs purport to represent a class of

over 35,000 current and former employees, and seek backpay, compensatory and punitive damages, as well as

attorneys’ fees. In August 2007, the Third Circuit Court of Appeals granted the Company’s Petition to hear the

appeal of the trial court’s recent certification order. The appeal will likely take one year. At this time, we have

not determined the amount of any liability that may result from this matter or whether such liability, if any,

would have a material adverse effect on our financial condition, results of operations, or liquidity.

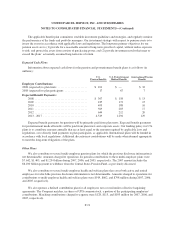

UPS and Mail Boxes Etc., Inc. are defendants in various lawsuits brought by franchisees who operate Mail

Boxes Etc. centers and The UPS Store locations. These lawsuits relate to the re-branding of Mail Boxes Etc.

F-27