UPS 2007 Annual Report Download - page 43

Download and view the complete annual report

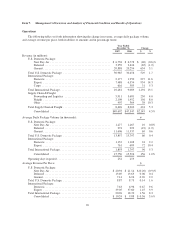

Please find page 43 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Expenses

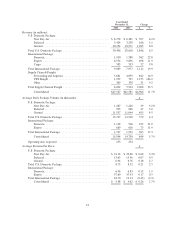

2007 compared to 2006

Consolidated operating expenses increased by $8.202 billion, or 20.0%, in 2007 compared with 2006.

Currency fluctuations in our International Package and Supply Chain & Freight segments resulted in

consolidated operating expenses increasing by $471 million for the year.

Compensation and benefits expense increased by $7.324 billion for the year, and was impacted by several

items including the charge for the withdrawal from the Central States Pension Fund, higher wage rates in the

union workforce, increased stock-based compensation, higher expense for union pension and welfare programs,

the SVSO charge, and the restructuring charge in our Supply Chain & Freight business in France. These

increases were slightly offset by lower workers compensation expense.

Our national master agreement with the International Brotherhood of Teamsters (“Teamsters”) allowed us,

upon ratification, to withdraw employees from the Central States Pension Fund and to establish a jointly trusteed

single-employer plan for this group. Upon ratification of the contract in December 2007 and our withdrawal from

the Central States Pension Fund, we recorded a pre-tax $6.100 billion charge to establish our withdrawal liability,

and made a December 2007 payment in the same amount to the Central States Pension Fund to satisfy this

liability.

In December 2006, we offered a special voluntary separation opportunity (“SVSO”) to approximately 640

employees who work in non-operating functions. This program was established to improve the efficiency of

non-operating processes by eliminating duplication and sharing expertise across the company. The SVSO ended

in February 2007, and 195, or 30% of eligible employees, accepted the offer. As a result, we recorded a charge to

expense of approximately $68 million in the first quarter of 2007, to reflect the cash payout and the acceleration

of stock compensation and certain retiree healthcare benefits under the SVSO program.

In the third quarter of 2007, we initiated a restructuring plan for our forwarding and logistics operations in

France. The objective of this restructuring plan was to reduce our forwarding and logistics cost structure and

focus on profitable revenue growth in the Europe region. The restructuring principally consisted of an

employment reduction program, which was ratified by our company’s trade union representatives in France in

July 2007. Employees participating in this program are entitled to severance benefits, including certain bonuses

for employees participating in the voluntary termination phase. These severance benefits are formula-driven and

are in accordance with French statutory laws as well as the applicable collective bargaining agreements. We

recorded a restructuring charge of $46 million ($42 million related to severance costs, and thus recorded in

compensation and benefits expense) in 2007 related to this program.

Stock-based and other management incentive compensation expense increased $113 million, or 17.7%,

during 2007, primarily due to 2007 awards of stock options, restricted performance units, and restricted stock

units. Pension and healthcare expense increased during the year, largely due to higher expense associated with

plans covering union employees, but was somewhat offset by lower expense for the UPS-sponsored pension

benefits (See Note 5 to the consolidated financial statements).

During the first quarter of 2005, we modified our Management Incentive Awards program under our

Incentive Compensation Plan to provide that half of the annual award be made in restricted stock units, with

certain exceptions for first time participants in the program. The restricted stock units granted each year under

this program generally have a five-year graded vesting period, with approximately 20% of the total restricted

stock unit award vesting at each anniversary date of the grant. The other half of the Management Incentive

Award granted each year is in the form of cash and unrestricted shares of Class A common stock and is fully

vested at the time of grant. Previous awards under the Management Incentive Awards program were made in

common stock that was fully vested in the year of grant. As discussed in Note 1 to the consolidated financial

statements, we recognize the expense associated with restricted stock unit awards over the appropriate vesting

28