UPS 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

beginning after December 15, 2007, and we will adopt the provisions of EITF 06-11 beginning in the first quarter

of 2008. EITF 06-11 is not expected to have a material impact on our results of operations or financial condition.

In December 2007 the FASB issued Statement No. 141(R) “Business Combinations” (“FAS 141(R)”). FAS

141(R) requires the acquiring entity in a business combination to recognize the full fair value of assets acquired

and liabilities assumed in the transaction (whether a full or partial acquisition); establishes the acquisition-date

fair value as the measurement objective for all assets acquired and liabilities assumed; requires expensing of most

transaction and restructuring costs; and requires the acquirer to disclose to investors and other users all of the

information needed to evaluate and understand the nature and financial effect of the business combination. FAS

141(R) applies prospectively to business combinations for which the acquisition date is on or after January 1,

2009. The impact of FAS No. 141R on our consolidated financial statements will depend upon the nature, terms

and size of the acquisitions we consummate after the effective date.

In December 2007, the FASB issued FAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements—an amendment of Accounting Research Bulletin No. 51” (“FAS 160”). FAS 160 requires reporting

entities to present noncontrolling (minority) interests as equity (as opposed to as a liability or mezzanine equity)

and provides guidance on the accounting for transactions between an entity and noncontrolling interests. As of

December 31, 2007, we had approximately $13 million in noncontrolling interests classified in other non-current

liabilities. FAS 160 applies prospectively as of January 1, 2009, except for the presentation and disclosure

requirements which will be applied retrospectively for all periods presented.

Changes in Presentation

Certain prior year amounts have been reclassified to conform to the current year presentation.

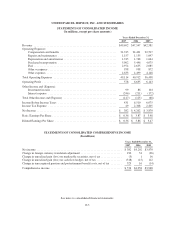

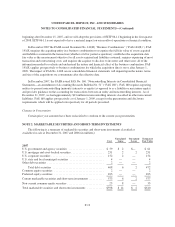

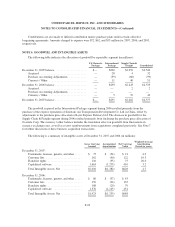

NOTE 2. MARKETABLE SECURITIES AND SHORT-TERM INVESTMENTS

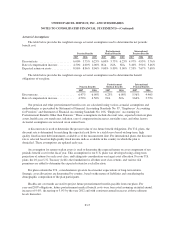

The following is a summary of marketable securities and short-term investments classified as

available-for-sale at December 31, 2007 and 2006 (in millions):

Cost

Unrealized

Gains

Unrealized

Losses

Estimated

Fair Value

2007

U.S. government and agency securities ......................... $ 59 $ 2 $— $ 61

U.S. mortgage and asset-backed securities ....................... 251 2 2 251

U.S. corporate securities ..................................... 152 2 — 154

U.S. state and local municipal securities ........................ 4 — — 4

Other debt securities ........................................ 2 — — 2

Total debt securities .................................... 468 6 2 472

Common equity securities ................................... 2 — — 2

Preferred equity securities ................................... 103 — — 103

Current marketable securities and short-term investments ........... 573 6 2 577

Non-current common equity securities .......................... 25 8 — 33

Total marketable securities and short-term investments ............ $598 $ 14 $ 2 $610

F-12