UPS 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

New Accounting Pronouncements

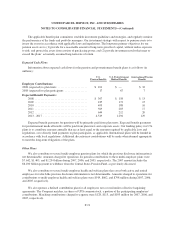

In September 2006, the FASB issued Statement No. 157 “Fair Value Measurements” (“FAS 157”), which

was issued to define fair value, establish a framework for measuring fair value, and expand disclosures about fair

value measurements, and is effective for fiscal years beginning after November 15, 2007. In February 2008, the

FASB deferred the effective date of FAS 157 for one year for certain nonfinancial assets and liabilities, and

removed certain leasing transactions from its scope. We adopted FAS 157 on January 1, 2008, and the impact of

adoption was not material to our results of operations or financial condition.

In September 2006, the FASB issued Statement No. 158 “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans (an amendment of FASB Statements No. 87, 88, 106, and 132(R))”

(“FAS 158”). This statement requires us to recognize the funded status of defined benefit pension and other

postretirement plans as an asset or liability in the balance sheet, and required delayed recognition items,

consisting of actuarial gains and losses and prior service costs and credits, to be recognized in other

comprehensive income and subsequently amortized to the income statement. On December 31, 2006, we adopted

the recognition and disclosure provisions of FAS 158, which resulted in a reduction to AOCI of $2.097 billion

and a reduction of long-term deferred tax liabilities of $1.258 billion.

Additionally, we currently utilize the early measurement date option available under Statement No. 87

“Employers’ Accounting for Pensions”, and we measure the funded status of our plans as of September 30 each

year. Under the provisions of FAS 158, we will be required to use a December 31 measurement date for all of our

pension and postretirement benefit plans beginning in 2008. As a result of this change in measurement date, we

recorded a cumulative effect after-tax $44 million reduction to retained earnings as of January 1, 2008.

In February 2007, the FASB issued Statement No. 159 “The Fair Value Option for Financial Assets and

Financial Liabilities” (“FAS 159”), which gives entities the option to measure eligible financial assets, financial

liabilities and firm commitments at fair value (i.e., the fair value option), on an instrument-by-instrument basis,

that are otherwise not accounted for at fair value under other accounting standards. The election to use the fair

value option is available at specified election dates, such as when an entity first recognizes a financial asset or

financial liability or upon entering into a firm commitment. Subsequent changes in fair value must be recorded in

earnings. Additionally, SFAS No. 159 allows for a one-time election for existing positions upon adoption, with

the transition adjustment recorded to beginning retained earnings. We adopted FAS 159 on January 1, 2008, and

elected to apply the fair value option to our investment in certain investment partnerships that were previously

accounted for under the equity method. Accordingly, we recorded an after-tax $12 million reduction to retained

earnings as of January 1, 2008, representing the cumulative effect adjustment of adopting FAS 159.

In June 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes—an Interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48 requires that we determine whether a

tax position is more likely than not to be sustained upon examination, including resolution of any related appeals

or litigation processes, based on the technical merits of the position. Once it is determined that a position meets

this recognition threshold, the position is measured to determine the amount of benefit to be recognized in the

financial statements. On January 1, 2007, we adopted the provisions of FIN 48, and the impact of this

Interpretation is discussed in Note 13.

In June 2007, the EITF reached consensus on Issue No. 06-11, “Accounting for Income Tax Benefits of

Dividends on Share-Based Payment Awards.” EITF 06-11 requires that the tax benefit related to dividend

equivalents paid on restricted stock units, which are expected to vest, be recorded as an increase to additional

paid-in capital. EITF 06-11 is to be applied prospectively for tax benefits on dividends declared in fiscal years

F-11