UPS 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

subject to earlier cancellation or vesting under certain conditions. Dividends earned on RPUs are reinvested in

additional restricted performance units at each dividend payable date. RPUs also allow for an additional award

equal to 10% of the outstanding RPUs to be issued if certain company-wide performance goals are attained in the

year of vesting. RPUs granted to eligible employees will generally be granted annually during the second quarter

of each year at the discretion of the Compensation Committee.

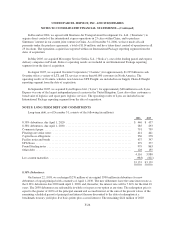

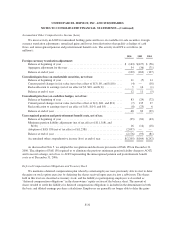

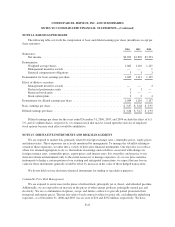

As of December 31, 2006, we had the following RPUs outstanding, including reinvested dividends:

Shares

(in thousands)

Weighted

Average

Grant Date

Fair Value

Weighted Average Remaining

Contractual Term

(in years)

Aggregate Intrinsic

Value (in millions)

Nonvested at January 1, 2006 ........ 2,886 $68.49

Vested .......................... (174) 70.93

Granted ......................... 990 80.88

Reinvested Dividends .............. 74 N/A

Forfeited / Expired ................ (107) 72.27

Nonvested at December 31, 2006 ..... 3,669 71.64 2.87 $275

RPUs Expected to Vest ............. 3,534 71.48 2.84 $265

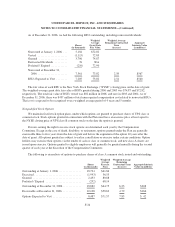

The fair value of each RPU is the NYSE closing price on the date of grant. The weighted-average grant date

fair value of RPUs granted during 2006, 2005, and 2004 was $80.88, $72.07, and $70.70, respectively. The total

fair value of RPUs vested during 2006, 2005, and 2004 was $13, $13, and $11 million, respectively. As of

December 31, 2006, there was $140 million of total unrecognized compensation cost related to nonvested RPUs.

That cost is expected to be recognized over a weighted average period of 3 years and 4 months.

Discounted Employee Stock Purchase Plan

We maintain an employee stock purchase plan for all eligible employees. Under the plan, shares of UPS

class A common stock may be purchased at quarterly intervals at 90% of the lower of the NYSE closing price of

UPS class B common stock on the first or the last day of each quarterly period. Employees purchased 1.9, 2.0,

and 1.8 million shares at average prices of $66.64, $64.54, and $62.75 per share during 2006, 2005, and 2004,

respectively. Compensation cost is measured for the fair value of employees’ purchase rights under our

discounted employee stock purchase plan using the Black-Scholes option pricing model.

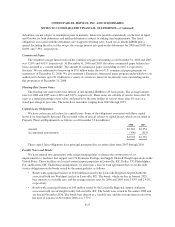

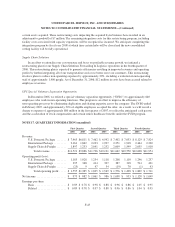

The weighted average assumptions used and the calculated weighted average fair value of employees’

purchase rights granted, are as follows:

2006 2005 2004

Expected dividend yield ............................................... 1.79% 1.62% 1.42%

Risk-free interest rate ................................................. 4.59% 2.84% 1.18%

Expected life in years ................................................. 0.25 0.25 0.25

Expected volatility ................................................... 15.92% 15.46% 16.83%

Weighted average fair value of purchase rights* ............................ $10.30 $ 9.46 $ 9.56

* Includes the 10% discount from the market price.

Expected volatilities are based on the historical price volatility on our publicly-traded class B shares. The

expected dividend yield is based on the recent historical dividend yields for our stock, taking into account

changes in dividend policy. The risk-free interest rate is based on the term structure of interest rates on U.S.

Treasury securities at the time of the option grant. The expected life represents the three month option period

applicable to the purchase rights.

F-36