UPS 2006 Annual Report Download - page 38

Download and view the complete annual report

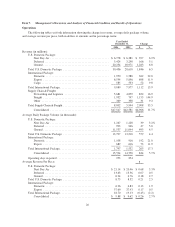

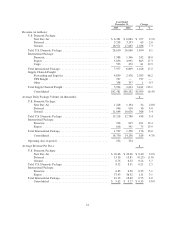

Please find page 38 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.U.S. Domestic Package Operations

2006 compared to 2005

U.S. Domestic Package revenue increased $1.846 billion, or 6.5%, for the year, with average daily package

volume up 4.4%. Volume gains were realized across all products primarily due to a solid U.S. economy, strong

small package market and continuing efforts to generate new volume. Overall domestic volume growth

moderated in the latter half of 2006 compared with 2005, due to slower overall economic growth in the U.S. and

a downturn in industrial production during the fourth quarter.

Pricing remained firm as overall revenue per piece was up 2.5% for the year. Ground revenue per piece

increased 2.7% and Next Day Air revenue per piece increased 3.3% for the year, primarily due to the impact of a

rate increase that took effect in 2006 and the impact of an increased fuel surcharge rate in 2006 compared to

2005. Deferred revenue per piece increased 0.5% for the year for the same reasons, but was adversely affected by

the growth in lighter weight, lower revenue packages.

On January 2, 2006, a rate increase took effect which was in line with previous years’ rate increases. We

increased rates 5.5% on UPS Next Day Air, UPS 2nd Day Air, and UPS 3 Day Select, and 3.9% on UPS Ground.

Other pricing changes included a new charge for undeliverable packages after three delivery attempts and an

increase in rates for proof of delivery features for our Delivery Required and Signature Confirmation services.

The residential surcharge increased $0.25 for UPS Ground services and $0.35 for UPS Next Day Air, UPS 2nd

Day Air and UPS 3 Day Select.

In January 2006, we modified the fuel surcharge on domestic air services by reducing the index used to

determine the fuel surcharge by 2%. The air fuel surcharge was subject to a maximum cap of 12.50% through

June 4, 2006. Effective June 5, 2006, we reduced the index by another 2% and no longer applied a cap to the air

fuel surcharge. This fuel surcharge continues to be based on the U.S. Energy Department’s Gulf Coast spot price

for a gallon of kerosene-type jet fuel. Based on published rates, the average fuel surcharge on domestic air

products was 14.02% in 2006, as compared with 10.23% in 2005. Additionally, the UPS Ground fuel surcharge

continues to fluctuate based on the U.S. Energy Department’s On-Highway Diesel Fuel Price. Based on

published rates, the average fuel surcharge on domestic ground products was 4.13% in 2006, as compared to

2.86% in 2005. Total domestic fuel surcharge revenue increased by $542 million in 2006, due to higher jet and

diesel fuel prices, volume growth, and the modifications to our fuel surcharges noted above. These fuel

surcharges are used to provide some protection against the increased fuel expense that we incur due to higher fuel

prices, as well as the increased purchased transportation expense which is also affected by higher fuel prices.

U.S. Domestic Package operating profit increased $430 million, or 9.6%, for the year, and the operating

margin increased by approximately 50 basis points to 16.2%. This increase was primarily a result of the revenue

growth described previously, combined with efficiencies from leveraging our integrated ground and air networks.

The 2006 operating profit for our U.S. Domestic Package segment was negatively impacted by a tentative

settlement of a class action litigation (see “Contingencies” section below), which resulted in an $87 million

charge to expense.

The expense associated with our self-insurance accruals for workers’ compensation claims, automotive

liability and general business liabilities was $83 million less in 2006 compared with 2005. Insurance reserves are

established for estimates of the loss that we will ultimately incur on reported claims, as well as estimates of

claims that have been incurred but not yet reported. Recorded balances are based on ultimate reserve levels

determined by outside actuaries, who incorporate historical loss experience and judgments about the present and

expected levels of cost per claim. The lower expense reflects favorable claims experience resulting from

company initiatives put into place over the last several years and other factors, including initiatives to decrease

accident frequencies, improved oversight and management of claims, improved trends in health care costs, and

favorable state legislative reforms, primarily in California.

23