UPS 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

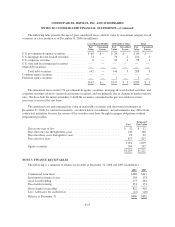

Outstanding receivable balances at December 31, 2006 and 2005 are net of unearned income of $29 and $34

million, respectively.

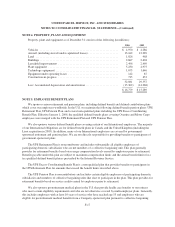

When we “factor” (i.e., purchase) a customer invoice from a client, we record the customer receivable as an

asset and also establish a liability for the funds due to the client, which is recorded in accounts payable on the

consolidated balance sheet. The following is a reconciliation of receivable factoring balances at December 31,

2006 and 2005 (in millions):

2006 2005

Customer receivable balances ............................................ $131 $151

Less:Amountsduetoclient.............................................. (77) (101)

Net funds employed .................................................... $ 54 $ 50

Non-earning finance receivables were $23 and $24 million at December 31, 2006 and 2005, respectively.

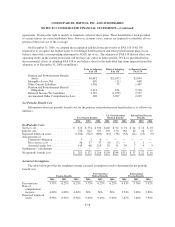

The following is a rollforward of the allowance for credit losses on finance receivables (in millions):

2006 2005

Balance at January 1 ..................................................... $20 $25

Provisions charged to operations ............................................ 8 11

Charge-offs, net of recoveries .............................................. (6) (16)

Balance at December 31 .................................................. $22 $20

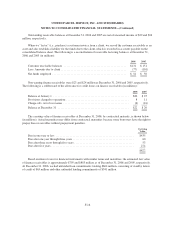

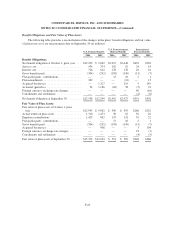

The carrying value of finance receivables at December 31, 2006, by contractual maturity, is shown below

(in millions). Actual maturities may differ from contractual maturities because some borrowers have the right to

prepay these receivables without prepayment penalties.

Carrying

Value

Due in one year or less ....................................................... $435

Due after one year through three years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

Due after three years through five years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Dueafterfiveyears.......................................................... 274

$822

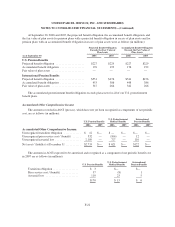

Based on interest rates for financial instruments with similar terms and maturities, the estimated fair value

of finance receivables is approximately $795 and $883 million as of December 31, 2006 and 2005, respectively.

At December 31, 2006, we had unfunded loan commitments totaling $604 million, consisting of standby letters

of credit of $63 million and other unfunded lending commitments of $541 million.

F-16