UPS 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

value of the Dayton facility was reduced to its fair market value as of the date of the acquisition. These accrued

costs, and related reductions in the fair value of recorded assets, resulted in an adjustment of $160 million to the

amount of goodwill initially recorded in the Menlo Worldwide Forwarding acquisition.

Additionally, we incurred costs related to integration activities, such as employee relocations, the moving of

inventory and fixed assets, and the consolidation of information systems, and these amounts were expensed as

incurred. We completed the majority of our integration activities for the air freight restructuring program in the

fourth quarter of 2006. The remaining restructuring liabilities existing as of December 31, 2006, primarily

represent costs that will continue to be incurred under various long-term contracts without any economic benefit

to our Company.

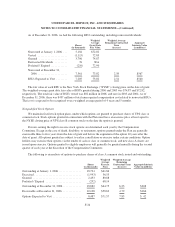

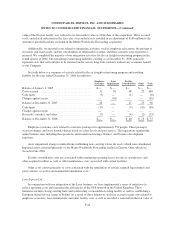

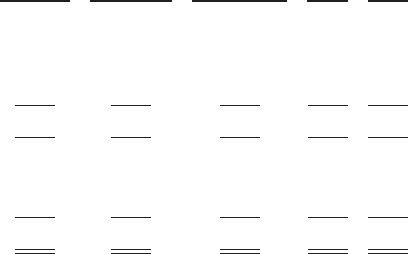

Set forth below is a summary of activity related to the air freight restructuring program and resulting

liability for the year ended December 31, 2006 (in millions):

Employee

Severance

Asset

Impairment

Facility

Consolidation Other Total

Balance at January 1, 2005 .......................... $— $— $— $— $—

Costs accrued ..................................... 31 56 48 25 160

Cash spent ....................................... (7) — (1) — (8)

Charges against assets .............................. — (56) — — (56)

Balance at December 31, 2005 ....................... 24 — 47 25 96

Cash spent ....................................... (17) — (3) (10) (30)

Charges against assets .............................. — — — — —

Reversals, currency, and other ........................ (7) — (4) (2) (13)

Balance at December 31, 2006 ....................... $— $— $ 40 $ 13 $ 53

Employee severance costs related to severance packages for approximately 550 people. These packages

were involuntary and were formula-driven based on salary levels and past service. The separations spanned the

entire business unit, including the operations, information technology, finance, and business development

functions.

Asset impairment charges resulted from establishing new carrying values for assets which were abandoned.

Impaired assets consisted primarily of the Menlo Worldwide Forwarding facility in Dayton, Ohio, which we

closed in June 2006.

Facility consolidation costs are associated with terminating operating leases on offices, warehouses, and

other acquired facilities as well as other maintenance costs associated with certain facilities.

Other costs consist primarily of costs associated with the termination of certain acquired legal entities and

joint ventures, as well as environmental remediation costs.

Lynx Express Ltd.

In conjunction with our integration of the Lynx business, we have implemented a series of initiatives to

reduce operating costs and maximize the efficiencies of the UPS network in the United Kingdom. These

initiatives include closing existing hubs and constructing a consolidated sorting facility as well as establishing a

European shared service center in Poland. As a result of these initiatives, we have accrued certain costs related to

employee severance, lease terminations and other facility costs as well as recorded a reduction in the fair value of

F-44