UPS 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

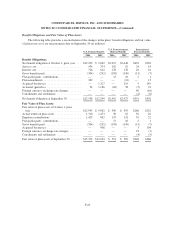

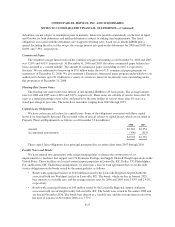

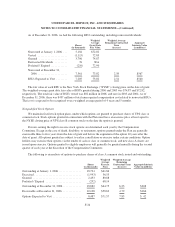

The following table sets forth the aggregate minimum lease payments under capital and operating leases, the

aggregate annual principal payments due under our long-term debt, and the aggregate amounts expected to be

spent for purchase commitments (in millions).

Year

Capital

Leases

Operating

Leases

Debt

Principal

Purchase

Commitments

2007 ................................................... $ 75 $ 404 $ 918 $1,072

2008 ................................................... 75 335 27 988

2009 ................................................... 41 243 83 499

2010 ................................................... 62 168 30 1,022

2011 ................................................... 1 119 33 1,184

After 2011 .............................................. — 505 2,766 1,636

Total .................................................. 254 $1,774 $3,857 $6,401

Less: imputed interest ..................................... (24)

Present value of minimum capitalized lease payments ............ 230

Less: current portion ...................................... (65)

Long-term capitalized lease obligations ....................... $165

As described in Note 18, we placed orders for 27 Boeing 767-300ER freighter aircraft in February 2007,

which are scheduled to be delivered between 2009 and 2012. Additionally, also described in Note 18, we reached

an agreement with Airbus in February 2007 to set out a timetable for deciding the status of our previous order for

the freighter version of the Airbus A380-800. We have included the purchase commitments associated with both

the new Boeing 767-300ER order and the existing Airbus A380-800 order in the purchase commitments

information presented in the table above.

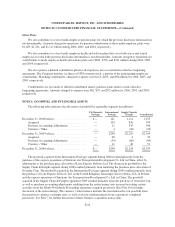

As of December 31, 2006, we had outstanding letters of credit totaling approximately $2.213 billion issued

in connection with routine business requirements.

We maintain two credit agreements with a consortium of banks that provide revolving credit facilities of

$1.0 billion each, with one expiring April 19, 2007 and the other April 21, 2010. Interest on any amounts we

borrow under these facilities would be charged at 90-day LIBOR plus 15 basis points. At December 31, 2006,

there were no outstanding borrowings under these facilities.

We have a $2.0 billion shelf registration statement under which we may issue debt securities in the U.S. The

debt may be denominated in a variety of currencies. There was approximately $136 million issued under this

shelf registration statement at December 31, 2006.

Our existing debt instruments and credit facilities do not have cross-default or ratings triggers, however

these debt instruments and credit facilities do subject us to certain financial covenants. These covenants generally

require us to maintain a $3.0 billion minimum net worth and limit the amount of secured indebtedness available

to the company. These covenants are not considered material to the overall financial condition of the company,

and all covenant tests were passed as of December 31, 2006.

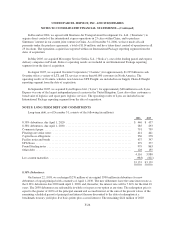

NOTE 9. LEGAL PROCEEDINGS AND CONTINGENCIES

We are a defendant in a number of lawsuits filed in state and federal courts containing various class-action

allegations under state wage-and-hour laws. In one of these cases, Marlo v. UPS, which has been certified as a

class action in a California federal court, plaintiffs allege that they improperly were denied overtime, and seek

penalties for missed meal and rest periods, and interest and attorneys’ fees. Plaintiffs purport to represent a class

F-29