UPS 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

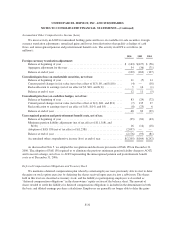

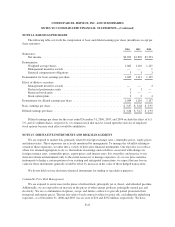

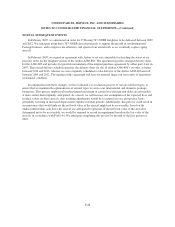

NOTE 14. EARNINGS PER SHARE

The following table sets forth the computation of basic and diluted earnings per share (in millions except per

share amounts):

2006 2005 2004

Numerator:

Net income ....................................................... $4,202 $3,870 $3,333

Denominator:

Weighted average shares ............................................ 1,082 1,110 1,125

Management incentive awards ........................................ — — 1

Deferred compensation obligations .................................... 3 3 3

Denominator for basic earnings per share ................................... 1,085 1,113 1,129

Effect of dilutive securities:

Management incentive awards ........................................ — — 4

Restricted performance units ......................................... 1 1 —

Restricted stock units ............................................... 1 — —

Stock option plans ................................................. 2 2 4

Denominator for diluted earnings per share .................................. 1,089 1,116 1,137

Basic earnings per share ................................................. $ 3.87 $ 3.48 $ 2.95

Diluted earnings per share ............................................... $ 3.86 $ 3.47 $ 2.93

Diluted earnings per share for the years ended December 31, 2006, 2005, and 2004 exclude the effect of 6.3,

5.9, and 4.1 million shares, respectively, of common stock that may be issued upon the exercise of employee

stock options because such effect would be antidilutive.

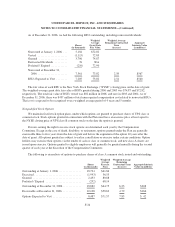

NOTE 15. DERIVATIVE INSTRUMENTS AND RISK MANAGEMENT

We are exposed to market risk, primarily related to foreign exchange rates, commodity prices, equity prices,

and interest rates. These exposures are actively monitored by management. To manage the volatility relating to

certain of these exposures, we enter into a variety of derivative financial instruments. Our objective is to reduce,

where it is deemed appropriate to do so, fluctuations in earnings and cash flows associated with changes in

foreign currency rates, commodity prices, equity prices, and interest rates. It is our policy and practice to use

derivative financial instruments only to the extent necessary to manage exposures. As we use price sensitive

instruments to hedge a certain portion of our existing and anticipated transactions, we expect that any loss in

value for those instruments generally would be offset by increases in the value of those hedged transactions.

We do not hold or issue derivative financial instruments for trading or speculative purposes.

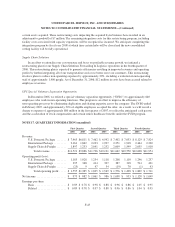

Commodity Price Risk Management

We are exposed to an increase in the prices of refined fuels, principally jet-A, diesel, and unleaded gasoline.

Additionally, we are exposed to an increase in the prices of other energy products, principally natural gas and

electricity. We use a combination of options, swaps, and futures contracts to provide partial protection from

rising fuel and energy prices. The net fair value of such contracts subject to price risk, excluding the underlying

exposures, as of December 31, 2006 and 2005 was an asset of $10 and $192 million, respectively. We have

F-41