UPS 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

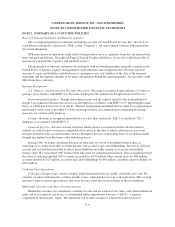

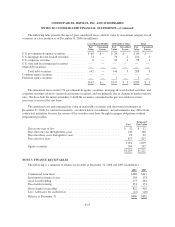

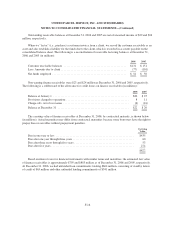

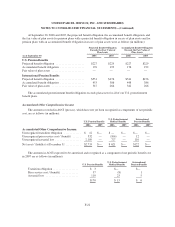

The following table presents the age of gross unrealized losses and fair value by investment category for all

securities in a loss position as of December 31, 2006 (in millions):

Less Than 12 Months 12 Months or More Total

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

U.S. government & agency securities ............. $ 60 $— $ 20 $— $ 80 $—

U.S. mortgage & asset-backed securities ........... 74 — 76 2 150 2

U.S. corporate securities ....................... 8 — 50 1 58 1

U.S. state and local municipal securities ........... — — ————

Other debt securities .......................... — — ————

Total debt securities ....................... 142 — 146 3 288 3

Common equity securities ...................... — — ————

Preferred equity securities ...................... — — 1 — 1 —

$142 $— $147 $ 3 $289 $ 3

The unrealized losses in the U.S. government & agency securities, mortgage & asset-backed securities, and

corporate securities relate to various fixed income securities, and are primarily due to changes in market interest

rates. We have both the intent and ability to hold the securities contained in the previous table for a time

necessary to recover the cost basis.

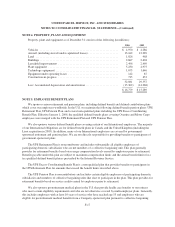

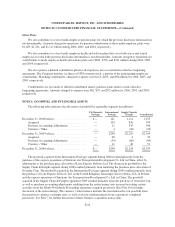

The amortized cost and estimated fair value of marketable securities and short-term investments at

December 31, 2006, by contractual maturity, are shown below (in millions). Actual maturities may differ from

contractual maturities because the issuers of the securities may have the right to prepay obligations without

prepayment penalties.

Cost

Estimated

Fair Value

Due in one year or less ............................................. $ 32 $ 32

Due after one year through three years ................................. 140 140

Due after three years through five years ................................ 22 22

Due after five years ................................................ 827 825

1,021 1,019

Equity securities .................................................. 184 202

$1,205 $1,221

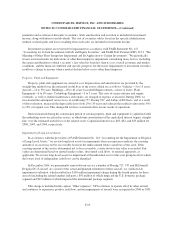

NOTE 3. FINANCE RECEIVABLES

The following is a summary of finance receivables at December 31, 2006 and 2005 (in millions):

2006 2005

Commercial term loans .................................................. $280 $317

Investment in finance leases .............................................. 138 153

Asset-basedlending..................................................... 273 281

Receivable factoring .................................................... 131 151

Gross finance receivables ................................................ 822 902

Less: Allowance for credit losses .......................................... (22) (20)

Balance at December 31 ................................................. $800 $882

F-15