UPS 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In an effort to rationalize our cost structure and focus on profitable revenue growth, we initiated a

restructuring plan for our forwarding and logistics operations in the fourth quarter of 2006. This restructuring

plan is expected to generate efficiencies resulting in improved operating profits by further integrating all of our

transportation services to better serve our customers. This restructuring involves plans to reduce non-operating

expenses by approximately 20%, including a reduction in non-operating staff of approximately 1,400 people. As

of December 31, 2006, $12 million in costs have been accrued related to employee severance.

2005 compared to 2004

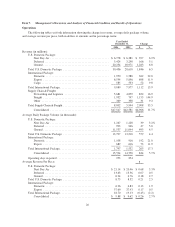

Supply Chain & Freight revenue increased $3.181 billion, or 113.1%, for the year. Forwarding services and

logistics revenue increased by $2.383 billion during the year, largely due to the acquisition of Menlo Worldwide

Forwarding in December 2004. The growth in our existing forwarding services and logistics businesses

(excluding Menlo Worldwide Forwarding) was driven by solid growth in our ocean and ground forwarding

operations. Revenue increased by $17 million during the year due to favorable currency fluctuations. Overall

growth continues to benefit from the expansion of our freight forwarding network throughout the world, as well

as the increase in global trade and the increased outsourcing of manufacturing and distribution.

During the third quarter of 2005, we completed our acquisition of Overnite Corp., now known as UPS

Freight, which offers a variety of LTL and truckload services to customers in North America. Overnite’s results

have been included in the Supply Chain & Freight reporting segment since the August 5, 2005 acquisition date.

Overnite generally reported improvements in its operating performance measures in the post-acquisition period

versus the same period a year ago when it was not a part of UPS, including improvements in average daily LTL

shipments and average LTL revenue per LTL hundredweight.

The other businesses within Supply Chain & Freight, which include our retail franchising business, our mail

and consulting services, and our financial business, increased revenue by 0.3% during the year. This revenue

growth was primarily due to increased revenue at our mail and financial services units.

Operating profit for the Supply Chain & Freight segment increased by $18 million, or 13.0%, for the year,

largely due to the operating profits generated by Overnite. Operating profit and margin were negatively affected

by operating losses incurred in the acquired Menlo Worldwide Forwarding operations, as well as costs incurred

in integrating this business into our existing forwarding services business. Currency fluctuations positively

affected operating profit by $4 million during the year. Operating profit also was favorably impacted by $15

million due to a change in our Management Incentive Awards program (discussed below in “Operating

Expenses”).

Operating Expenses

2006 compared to 2005

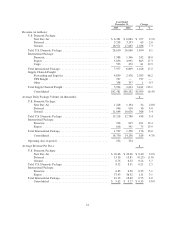

Consolidated operating expenses increased by $4.474 billion, or 12.3%, for the year, and were significantly

impacted by the acquisitions of Overnite, Stolica, and Lynx. Currency fluctuations in our International Package

and Supply Chain & Freight segments resulted in operating expenses increasing by $84 million for the year.

Compensation and benefits increased by $1.904 billion, or 8.5%, for the year, largely due to the acquisitions

mentioned above, as well as increased health and welfare benefit costs and higher pension expense. These

increases were partially offset by the decline in workers compensation expense, as previously discussed.

Excluding the effect of acquisitions, compensation and benefits expense increased 5.1% for the year. Stock-based

and other management incentive compensation expense increased $49 million, or 8.0% in 2006, due to the

expensing of restricted stock units granted in the fourth quarter of 2005, the impact of a new grant of stock

options and restricted performance units in the second quarter of 2006, and the impact of adopting the non-

substantive vesting period approach of FAS 123R (discussed further in Note 1 to the consolidated financial

statements). These grants were partially offset by lower accruals for our Management Incentive Awards program

in 2006.

27