UPS 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

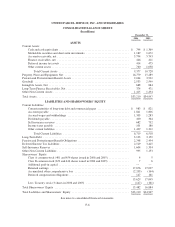

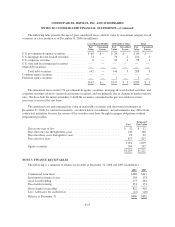

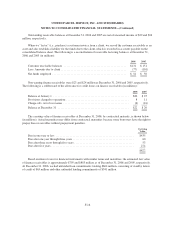

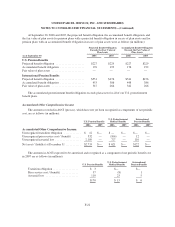

NOTE 2. MARKETABLE SECURITIES AND SHORT-TERM INVESTMENTS

The following is a summary of marketable securities and short-term investments classified as available-for-

sale at December 31, 2006 and 2005 (in millions):

Cost

Unrealized

Gains

Unrealized

Losses

Estimated

Fair Value

2006

U.S. government & agency securities ......................... $ 124 $— $— $ 124

U.S. mortgage & asset-backed securities ...................... 234 1 2 233

U.S. corporate securities ................................... 79 — 1 78

U.S. state and local municipal securities ....................... 582 — — 582

Other debt securities ...................................... 2 — — 2

Total debt securities ................................... 1,021 1 3 1,019

Common equity securities .................................. 38 10 — 48

Preferred equity securities .................................. 122 — — 122

Current marketable securities & short-term investments .......... 1,181 11 3 1,189

Non-current common equity securities ........................ 24 8 — 32

Total marketable securities & short-term investments ............ $1,205 $ 19 $ 3 $1,221

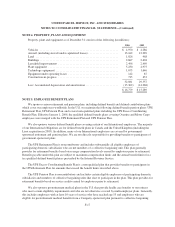

Cost

Unrealized

Gains

Unrealized

Losses

Estimated

Fair Value

2005

U.S. government & agency securities ......................... $ 400 $ 1 $ 3 $ 398

U.S. mortgage & asset-backed securities ...................... 393 1 5 389

U.S. corporate securities ................................... 425 — 4 421

U.S. state and local municipal securities ....................... 70 — — 70

Other debt securities ...................................... 2 — — 2

Total debt securities ................................... 1,290 2 12 1,280

Common equity securities .................................. 42 19 — 61

Preferred equity securities .................................. 331 — — 331

Current marketable securities & short-term investments .......... 1,663 21 12 1,672

Non-current common equity securities ........................ 21 7 — 28

Total marketable securities & short-term investments ............ $1,684 $ 28 $ 12 $1,700

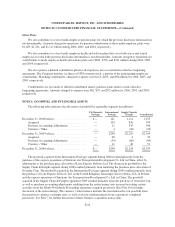

The gross realized gains on sales of marketable securities totaled $12, $2, and $7 million in 2006, 2005, and

2004, respectively. The gross realized losses totaled $21, $12, and $5 million in 2006, 2005, and 2004,

respectively. Impairment losses recognized on marketable securities and short-term investments totaled $16

million during 2005, with no such losses recognized in 2006 or 2004.

F-14