UPS 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

premiums and accretion of discounts to maturity. Such amortization and accretion is included in investment

income, along with interest and dividends. The cost of securities sold is based on the specific identification

method; realized gains and losses resulting from such sales are included in investment income.

Investment securities are reviewed for impairment in accordance with FASB Statement No. 115

“Accounting for Certain Investments in Debt and Equity Securities” and FASB Staff Position (FSP) 115-1 “The

Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments.” We periodically

review our investments for indications of other than temporary impairment considering many factors, including

the extent and duration to which a security’s fair value has been less than its cost, overall economic and market

conditions, and the financial condition and specific prospects for the issuer. Impairment of investment securities

results in a charge to income when a market decline below cost is other than temporary.

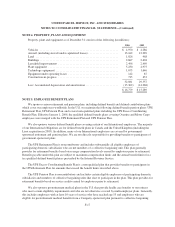

Property, Plant and Equipment

Property, plant and equipment are carried at cost. Depreciation and amortization are provided by the

straight-line method over the estimated useful lives of the assets, which are as follows: Vehicles—3 to 15 years;

Aircraft—12 to 30 years; Buildings—20 to 40 years; Leasehold Improvements—terms of leases; Plant

Equipment—6 to 10 years; Technology Equipment—3 to 5 years. The costs of major airframe and engine

overhauls, as well as routine maintenance and repairs, are charged to expense as incurred. During 2006, we

reevaluated the anticipated service lives of our Boeing 757, Boeing 767, and Airbus A300 fleets, and as a result

of this evaluation, increased the depreciable lives from 20 to 30 years and reduced the residual values from 30%

to 10% of original cost. This change did not have a material effect on our results of operations.

Interest incurred during the construction period of certain property, plant and equipment is capitalized until

the underlying assets are placed in service, at which time amortization of the capitalized interest begins, straight-

line, over the estimated useful lives of the related assets. Capitalized interest was $48, $32, and $25 million for

2006, 2005, and 2004, respectively.

Impairment of Long-Lived Assets

In accordance with the provisions of FASB Statement No. 144 “Accounting for the Impairment or Disposal

of Long-Lived Assets,” we review long-lived assets for impairment when circumstances indicate the carrying

amount of an asset may not be recoverable based on the undiscounted future cash flows of the asset. If the

carrying amount of the asset is determined not to be recoverable, a write-down to fair value is recorded. Fair

values are determined based on quoted market values, discounted cash flows, or external appraisals, as

applicable. We review long-lived assets for impairment at the individual asset or the asset group level for which

the lowest level of independent cash flows can be identified.

In December 2004, we permanently removed from service a number of Boeing 727, 747 and McDonnell

Douglas DC-8 aircraft. As a result of the actual and planned retirement of these aircraft, we conducted an

impairment evaluation, which resulted in a $110 million impairment charge during the fourth quarter for these

aircraft (including the related engines and parts), $91 million of which impacted the U.S. domestic package

segment and $19 million of which impacted the international package segment.

This charge is included in the caption “Other expenses”. UPS continues to operate all of its other aircraft

and continues to experience positive cash flow, and no impairments of aircraft were recognized in 2006 or 2005.

F-10