UPS 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

vote per share. Class A shares are primarily held by UPS employees and retirees, and these shares are fully

convertible into Class B shares at any time. Class B shares are publicly traded on the New York Stock Exchange

(NYSE) under the symbol “UPS.” Class A and B shares both have a $0.01 par value, and as of December 31,

2006, there were 4.6 billion Class A shares and 5.6 billion Class B shares authorized to be issued. Additionally,

there are 200 million preferred shares, with no par value, authorized to be issued; as of December 31, 2006, no

preferred shares had been issued.

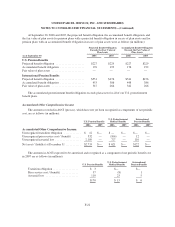

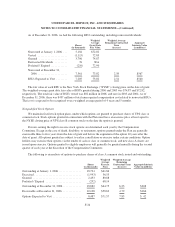

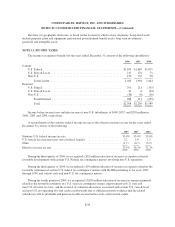

The following is a rollforward of our common stock, additional paid-in capital, and retained earnings

accounts (in millions, except per share amounts):

2006 2005 2004

Shares Dollars Shares Dollars Shares Dollars

Class A Common Stock

Balance at beginning of year .................. 454 $ 5 515 $ 5 571 $ 6

Common stock purchases ..................... (17) — (16) — (12) —

Stock award plans ........................... 3 — 2 — 12 —

Common stock issuances ..................... 2 — 3 — 3 —

Conversions of Class A to Class B common

stock ................................... (41) (1) (50) — (59) (1)

Class A shares issued at end of year ............. 401 $ 4 454 $ 5 515 $ 5

Class B Common Stock

Balance at beginning of year .................. 646 $ 6 614 $ 6 560 $ 5

Common stock purchases ..................... (15) — (18) — (5) —

Conversions of Class A to Class B common

stock ................................... 41 1 50 — 59 1

Class B shares issued at end of year ............. 672 $ 7 646 $ 6 614 $ 6

Additional Paid-In Capital

Balance at beginning of year .................. $ — $ 417 $ 662

Stock award plans ........................... 371 335 677

Common stock purchases ..................... (539) (922) (1,075)

Common stock issuances ..................... 168 170 153

Balance at end of year ....................... $ — $ — $ 417

Retained Earnings

Balance at beginning of year .................. $17,037 $16,192 $14,356

Net income ................................ 4,202 3,870 3,333

Dividends ($1.52, $1.32, and $1.12 per share) ..... (1,647) (1,468) (1,262)

Common stock purchases ..................... (1,916) (1,557) (235)

Balance at end of year ....................... $17,676 $17,037 $16,192

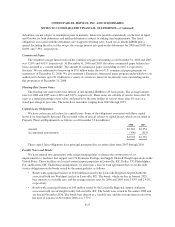

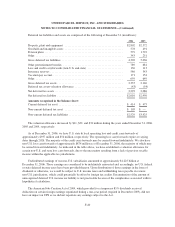

We repurchased a total of 32.6 million shares of Class A and Class B common stock for $2.455 billion in

2006, and 33.9 million shares for $2.479 billion in 2005. As of December 31, 2006, we had $936 million of our

share repurchase authorization remaining. In February 2007, the Board of Directors approved an increase in our

share repurchase authorization to $2.0 billion, which replaces the remaining amount available under our July

2006 share repurchase authorization.

F-31