UPS 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

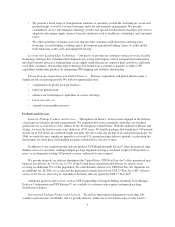

Revenue (in billions)

$0

$10

$20

$30

$40

$50

06

47.6

05

040302

42.6

36.6

33.5

31.3

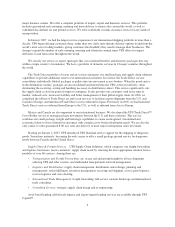

Diluted EPS (in dollars)

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$0

06

3.86

05

040302

3.47

2.93

2.55

2.81

0%

5%

10%

15%

20%

25%

Return on Invested Capital

(in percent)

06

22.1

05

040302

19.7

17.9

17.4

17.3

During this fi ve-year period, UPS completed

11 acquisitions at a total investment of almost

$1.8 billion. These acquisitions have extended

the UPS presence in key geographies around the

world—notably China, Japan, and Europe. In

addition, acquisitions have broadened the breadth

of capabilities we offer, which now include freight

forwarding, time-defi nite delivery of heavy air

freight, and less-than-truckload services.

The second priority for our use of cash is

return to shareowners through dividends and

share repurchases.

Dividend growth has been impressive in the last fi ve

years, with declared dividends doubling to $1.52

per share in 2006. The pay-out ratio has gradually

increased to 39 percent in 2006. And dividend yield

at 2 percent is above the average yield of the S&P

500 Index.

Share repurchases have played a signifi cant role in

returning value to shareowners. From 2002 through

2006, UPS repurchased almost 102 million shares

at a total cost of over $7 billion.

The bottom line is that we have invested $26 billion

in the last fi ve years in capital expenditures,

acquisitions, dividends, and share repurchases—all

to enhance long-term value for shareowners.

LOOKING TO THE FUTURE

We are on track to attain our 2010 performance goals

(which are based on 2005 results), despite the challenge

a slower-growth U.S. economy will bring in 2007.

With organic revenue growth between 6 and

8 percent, by 2010 UPS should realize revenue of

approximately $60 billion. Business unit contribu-

tion to operating profi t should evolve somewhat,

with the International segment contributing about

33 percent (compared with 26 percent in 2006). The

U.S. Small Package segment should remain strong

and post steady gains, while the Supply Chain

and Freight segment is expected to be producing

positive returns. Earnings per share compound

annual growth rate is expected to range between 9

and 14 percent.

By 2010, cash from operations should exceed

$9 billion, more than a 50 percent increase over

2006 results. Our approach to the use of cash likely

will not change dramatically over the next several

years. We are dedicated to reinvesting in the business,

and will be patient and careful with our investment

decisions. We also intend to continue returning

cash directly to shareowners in the form of in-

creased dividends and share repurchases. Decisions

on the magnitude and form of distributions will

9