UPS 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

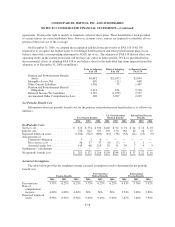

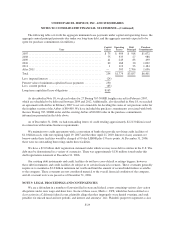

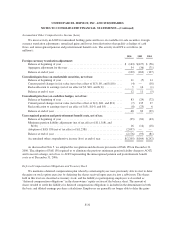

Plan Asset Investment Policy

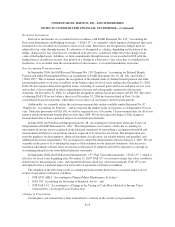

The asset allocation for our U.S. pension and other postretirement plans as of September 30, 2006 and 2005

and the target allocation as of September 30, 2006, by asset category, are as follows:

Weighted Average

Target Allocation

2006

Percentage of

Plan Assets at

September 30,

2006 2005

Equity securities ....................................... 55%-65% 61.5% 62.1%

Debt securities ........................................ 20%-30% 26.5% 25.9%

Real estate / other ...................................... 10%-15% 12.0% 12.0%

Total ................................................ 100.0% 100.0%

Equity securities include UPS Class A shares of common stock in the amounts of $440 (2.8% of total plan

assets) and $423 million (3.4% of total plan assets), as of September 30, 2006 and 2005, respectively.

The applicable benefit plan committees establish investment guidelines and strategies, and regularly monitor

the performance of the funds and portfolio managers. Our investment strategy with respect to pension assets is to

invest the assets in accordance with applicable laws and regulations. The long-term primary objectives for our

pension assets are to (1) provide for a reasonable amount of long-term growth of capital, without undue exposure

to risk; and protect the assets from erosion of purchasing power, and (2) provide investment results that meet or

exceed the plans’ actuarially assumed long-term rate of return.

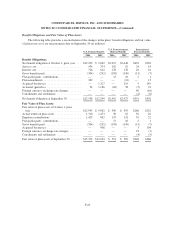

Expected Cash Flows

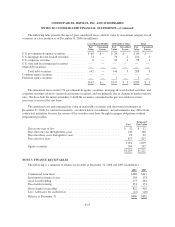

Information about expected cash flows for the pension and postretirement benefit plans is as follows (in

millions):

U.S.

Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Employer Contributions:

2007 (expected) to plan trusts ..................... $ 461 $ 72 $48

2007 (expected) to plan participants ................ 19 52 2

Expected Benefit Payments:

2007 ..................................... $ 340 $ 138 $ 9

2008 ..................................... 404 148 10

2009 ..................................... 440 160 11

2010 ..................................... 486 174 12

2011 ..................................... 537 189 14

2012-2016................................ 3,679 1,175 93

Expected benefit payments for pensions will be primarily paid from plan trusts. Expected benefit payments

for postretirement benefits will be paid from plan trusts and corporate assets. Our funding policy for U.S. plans is

to contribute amounts annually that are at least equal to the amounts required by applicable laws and regulations,

or to directly fund payments to plan participants, as applicable. International plans will be funded in accordance

with local regulations. We have also guaranteed our obligations for certain international pension plans up to a

maximum amount of $118 million. Additional discretionary contributions will be made when deemed

appropriate to meet the long-term obligations of the plans.

F-23