UPS 2006 Annual Report Download - page 41

Download and view the complete annual report

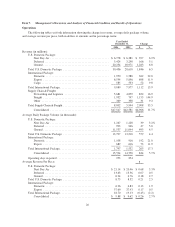

Please find page 41 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.increased 12.4% for the year, due to volume growth in Canada and Europe, which also benefited from the

acquisition of Messenger Service Stolica S.A. in Poland during the second quarter of 2005 and Lynx Express

Ltd. in the United Kingdom in the third quarter of 2005. Excluding the impact of acquisitions, international

domestic volume increased 3.7%.

Export revenue per piece increased 3.1% for the year (1.4% currency-adjusted), due to the rate increases

discussed previously and the impact of the fuel surcharge, but was adversely affected by relatively higher growth

in lower revenue per piece transborder product. In total, international average daily package volume increased

13.0% and average revenue per piece increased 4.0% (2.4% currency-adjusted).

The improvement in operating profit for our International Package operations was $345 million for the year,

or 30.0%, with an increase in the operating margin of 180 basis points. This increase in operating profit and

margin was positively impacted by the strong volume growth described previously, as well as better network

utilization due to volume growth and geographic service expansion. The increase in operating profit was also

favorably affected by $78 million due to the impact of currency fluctuations on revenue and expense (net of

hedging activity), and by $45 million due to a change in our Management Incentive Awards program (discussed

below in “Operating Expenses”). Operating profit was negatively affected in 2005 by $23 million in currency

repatriation losses, as compared with repatriation gains of $32 million in 2004.

Supply Chain & Freight Operations

2006 compared to 2005

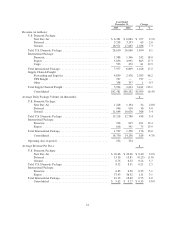

Supply Chain & Freight revenue increased $2.008 billion, or 33.5%, for the year. UPS Freight, formerly

known as Overnite Corp., provided $1.155 billion of the increase in revenue for the year. Excluding the impact of

the Overnite acquisition in August 2005, segment revenues grew 16.4% for the year. Total average daily LTL

shipments for UPS Freight in 2006 declined against the full year 2005 (both the pre and post-acquisition period)

due to service issues caused by the integration of the UPS Freight business, as well as a weakening in the overall

LTL market in the United States in the latter half of 2006. LTL revenue per LTL hundredweight increased as we

proactively reduced less profitable accounts and focused on higher yielding customer segments.

Forwarding and logistics revenue increased $822 million, or 16.9% for the year, largely due to continued

changes in the business model for this unit. The forwarding and logistics business is moving towards a model

that places more transactional ownership risk on UPS, including increased utilization of UPS-owned assets. This

has the effect of increasing revenue as well as purchased transportation expense. The increased revenue

associated with these forwarding transactions was somewhat offset by certain revenue management initiatives,

which involved reducing less profitable accounts. In addition, revenue increased by $29 million during the year

due to currency fluctuations.

The other businesses within Supply Chain & Freight, which include our retail franchising business and our

financial business, increased revenue by 9.2% during the year. This revenue growth was primarily due to

increased financial services revenue, as well as revenue earned from our previously-announced contract to

provide domestic air transportation for the U.S. Postal Service.

For the year, the Supply Chain & Freight segment reported $2 million in operating profit, as compared with

a $156 million in operating profit for 2005. These results were impacted by the integration of the acquired Menlo

Worldwide Forwarding business into our air network, and the integration of the Motor Cargo business unit within

the acquired Overnite Corp. operations into the UPS Freight network. The UPS Freight integration led to service

issues, which resulted in a loss of revenue, as well as productivity setbacks resulting in increased costs. The

integration of the Menlo Worldwide Forwarding business resulted in increased costs and some lost sales resulting

from customer turnover. The increase in operating profit was positively affected by $2 million during 2006 due

to the impact of currency fluctuations on revenue and expense.

26