UPS 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

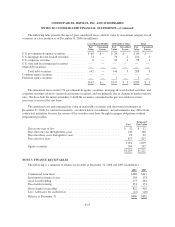

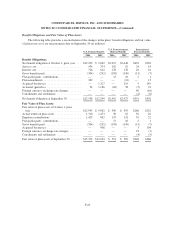

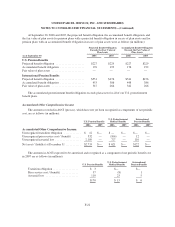

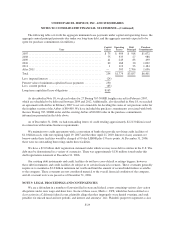

Funded Status

The following table discloses the funded status of our plans as of our measurement date on September 30

and the amounts recognized in our balance sheet as of year-end, on a pre-tax basis (in millions):

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International

Pension Benefits

2006 2005 2006 2005 2006 2005

Funded Status:

Fair value of plan assets at September 30 .......... $15,374 $ 12,943 $ 551 $ 509 $ 348 $ 266

Benefit obligation at September 30 ............... (13,558) (12,299) (2,992) (2,927) (551) (476)

Funded Status at September 30 .................. 1,816 644 (2,441) (2,418) (203) (210)

Amounts Not Yet Recognized in Net Periodic

Cost:

Unrecognized net transition obligation ............ 12 15 — — — —

Unrecognized net prior service cost / (benefit) ...... 532 260 (106) (118) 12 14

Unrecognized net actuarial loss ................. 2,189 2,486 727 817 110 127

Employer contributions ........................ 9 2 20 15 22 6

Net asset / (liability) at December 31 ............. $ 4,558 $ 3,407 $(1,800) $(1,704) $ (59) $ (63)

Amounts Recognized in our Balance Sheet:

Pension and postretirement benefit assets .......... $ 2,043 $ 3,931 $ — $ — $ 1 $ 1

Intangible assets, net .......................... — 2 — — — 11

Other current liabilities ........................ (19) — (52) — (2) —

Pension and postretirement benefit obligations ..... (199) (619) (2,369) (1,704) (180) (131)

Accumulated other comprehensive loss ........... 2,733 93 621 — 122 56

Net asset / (liability) at December 31 ............. $ 4,558 $ 3,407 $(1,800) $(1,704) $ (59) $ (63)

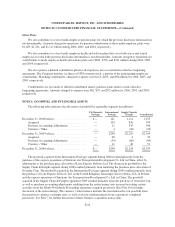

The accumulated benefit obligation for our pension plans as of September 30, 2006 and 2005 was $12.481

and $11.485 billion, respectively. In general, we use a measurement date of September 30 for our pension and

postretirement benefit plans.

Employer contributions and benefits paid under the pension plans include $24 and $9 million paid from

employer assets in 2006 and 2005, respectively. Employer contributions and benefits paid (net of participant

contributions) under the postretirement medical benefit plans include $72 and $69 million paid from employer

assets in 2006 and 2005, respectively.

F-21