UPS 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

agreements. We have the right to modify or terminate certain of these plans. These benefits have been provided

to certain retirees on a noncontributory basis; however, in many cases, retirees are required to contribute all or a

portion of the total cost of the coverage.

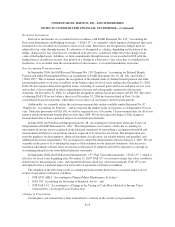

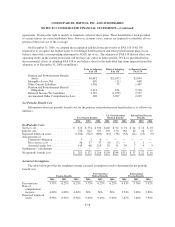

On December 31, 2006, we adopted the recognition and disclosure provisions of FAS 158. FAS 158

required us to recognize the funded status of our defined benefit pension and other postretirement plans in our

balance sheet with a corresponding adjustment to AOCI, net of tax. The adoption of FAS 158 did not affect our

operating results in the current period and will not have any effect in future periods. We have presented below

the incremental effects of adopting FAS 158 to our balance sheet for the individual line items impacted from this

adoption, as of December 31, 2006 (in millions).

Prior to Adopting

FAS 158

Effect of Adopting

FAS 158

As Reported under

FAS 158

Pension and Postretirement Benefit

Assets ............................. $4,681 $(2,637) $2,044

Intangible Assets, Net .................. 699 (11) 688

Other Current Liabilities ................ 1,336 73 1,409

Pension and Postretirement Benefit

Obligations . . . . . . . . . . . . . . . . . . . . . . . . . 2,114 634 2,748

Deferred Income Tax Liabilities .......... 3,787 (1,258) 2,529

Accumulated Other Comprehensive Loss . . . 108 2,097 2,205

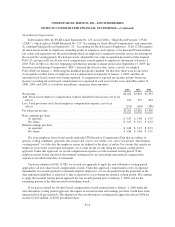

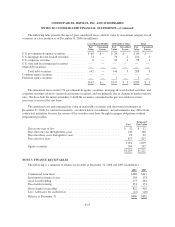

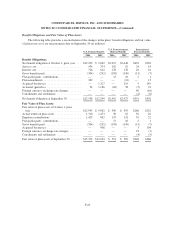

Net Periodic Benefit Cost

Information about net periodic benefit cost for the pension and postretirement benefit plans is as follows (in

millions):

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

2006 2005 2004 2006 2005 2004 2006 2005 2004

Net Periodic Cost:

Service cost ....................... $ 474 $374 $334 $102 $ 92 $ 91 $ 24 $ 14 $ 10

Interest cost ....................... 726 612 521 170 170 164 26 16 12

Expected return on assets ............. (1,106) (922) (800) (43) (38) (34) (22) (13) (9)

Amortization of:

Transition obligation ............ 3 3 6 ——————

Prior service cost ............... 36 37 37 (8) (7) — 1 1 —

Actuarial (gain) loss ............. 148 68 118 29 31 30 7 4 3

Settlements / curtailments ............ — — ———— 1——

Net periodic benefit cost ............. $ 281 $172 $216 $250 $248 $251 $ 37 $ 22 $ 16

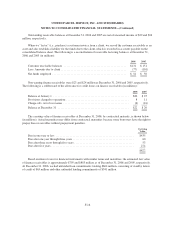

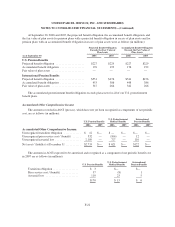

Actuarial Assumptions

The table below provides the weighted-average actuarial assumptions used to determine the net periodic

benefit cost.

Pension Benefits

Postretirement

Medical Benefits

International

Pension Benefits

2006 2005 2004 2006 2005 2004 2006 2005 2004

Discount rate .... 5.75% 6.25% 6.25% 5.75% 6.25% 6.25% 4.93% 5.76% 5.92%

Rate of

compensation

increase . . . . . . . 4.00% 4.00% 4.00% N/A N/A N/A 3.94% 3.46% 2.88%

Expected return on

assets ........ 8.96% 8.96% 8.96% 9.00% 9.00% 9.00% 7.67% 7.68% 7.90%

F-18