UPS 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

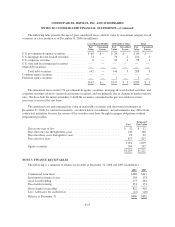

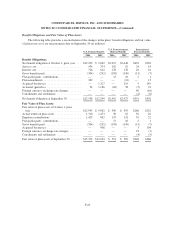

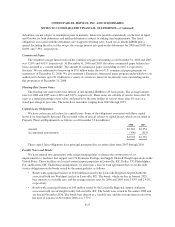

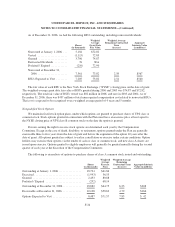

The following is a summary of intangible assets at December 31, 2006 and 2005 (in millions):

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Value

Weighted-Average

Amortization

Period (in years)

December 31, 2006:

Trademarks, licenses, patents, and other ..... $ 80 $ (37) $ 43 4.2

Customer lists ......................... 159 (24) 135 10.5

Franchise rights ........................ 108 (29) 79 20.0

Capitalized software .................... 1,576 (1,145) 431 3.2

Total Intangible Assets, Net .............. $1,923 $(1,235) $688 4.8

December 31, 2005:

Trademarks, licenses, patents, and other ..... $ 43 $ (20) $ 23

Customer lists ......................... 78 (5) 73

Franchise rights ........................ 108 (23) 85

Capitalized software .................... 1,409 (919) 490

Intangible pension asset .................. 13 — 13

Total Intangible Assets, Net .............. $1,651 $ (967) $684

Amortization of intangible assets was $255, $255, and $221 million during 2006, 2005 and 2004,

respectively. Expected amortization of finite-lived intangible assets recorded as of December 31, 2006 for the

next five years is as follows (in millions): 2007—$181; 2008—$131; 2009—$70; 2010—$24; 2011—$20.

Amortization expense in future periods will be affected by business acquisitions, software development, and

other factors.

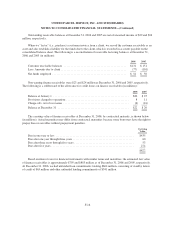

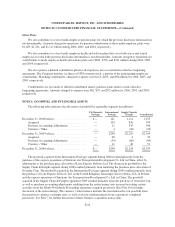

NOTE 7. BUSINESS ACQUISITIONS AND DISPOSITIONS

We regularly explore opportunities to make acquisitions that would enhance our businesses. During the

three years ended December 31, 2006, we completed several acquisitions, including both domestic and

international transactions, which were accounted for under the purchase method of accounting. In connection

with these transactions, we paid cash (net of cash acquired) in the aggregate amount of $50 million, $1.488

billion, and $238 million in 2006, 2005, and 2004, respectively. Pro forma results of operations have not been

presented for any of the acquisitions because the effects of these transactions were not material on either an

individual or aggregate basis. The results of operations of each acquired company are included in our statements

of consolidated income from the date of acquisition. The purchase price allocations of acquired companies can be

modified up to one year after the date of acquisition.

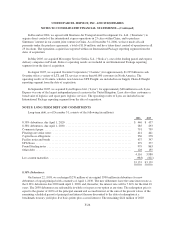

In March 2004, we acquired the remaining 49% minority interest in UPS Yamato Express Co., which was

previously a joint venture with Yamato Transport Co. in Japan, for $65 million in cash. UPS Yamato Express

provides express package delivery services in Japan. Upon the close of the acquisition, UPS Yamato Express

became a wholly-owned subsidiary of UPS, and is included in our International Package reporting segment. The

acquisition had no material effect on our financial condition or results of operations.

In December 2004, we acquired Menlo Worldwide Forwarding, Inc. from CNF Inc. for $150 million in cash

(net of cash acquired) plus the assumption of $110 million in principal amount of debt and capital lease

obligations. Menlo Worldwide Forwarding, Inc. was a global freight forwarder that provided a full suite of heavy

air freight forwarding services, ocean services and international trade management, including customs brokerage.

The former operations of Menlo Worldwide Forwarding, Inc. are included as part of our Supply Chain & Freight

reporting segment.

F-25