Tyson Foods 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 55

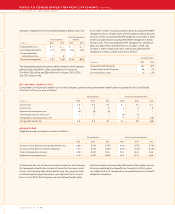

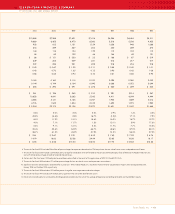

Additionally, net income includes a non-recurring income tax net

benefit of $15 million. The net benefit includes the reversal of tax

reserves, partially offset by an income tax charge related to the

repatriation of foreign income.

First quarter fiscal 2004 gross profit included $61 million in BSE-

related charges and operating income included $21 million and

$4 million in charges related to the closing of prepared foods facili-

ties and poultry operations, respectively. Second quarter fiscal 2004

operating income included charges of $6 million and $8 million

related to the closings of prepared foods facilities and poultry

operations, respectively. Third quarter fiscal 2004 operating income

included charges of $1 million related to the closing of a poultry

operation. Fourth quarter fiscal 2004 gross profit included $18 million

to reduce self-insurance reserves to the actuarially determined

range. The reserves are compared to actuarial estimates quarterly.

Fourth quarter fiscal 2004 operating income included charges of

$25 million related to the impairment of various intangible assets

and $21 million related to fixed asset write-downs.

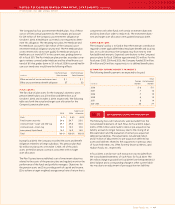

CONTINGENCIES

>> 21

Listed below are certain claims made against the Company and its

subsidiaries. In the Company’s opinion, it has made appropriate and

adequate reserves, accruals and disclosures where necessary and

the Company believes the probability of a material loss beyond

the amounts accrued to be remote; however, the ultimate liability

for these matters is uncertain, and if accruals and reserves are not

adequate, an adverse outcome could have a material effect on

the consolidated financial condition or results of operations of

the Company. The Company believes it has substantial defenses

to the claims made and intends to vigorously defend these cases.

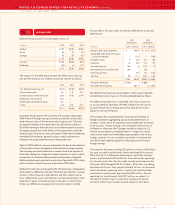

Wage and Hour/Labor Matters: In 2000, the Wage and Hour

Division of the U.S. Department of Labor (DOL) conducted an

industry-wide investigation of poultry producers, including the

Company, to ascertain compliance with various wage and hour

issues. As part of this investigation, the DOL inspected 14 of the

Company’s processing facilities. On May 9, 2002, a civil complaint

was filed against the Company in the U.S. District Court for the

Northern District of Alabama, Elaine L. Chao, Secretary of Labor,

United States Department of Labor v. Tyson Foods, Inc. The

complaint alleges that the Company violated the overtime

provisions of the federal Fair Labor Standards Act (FLSA) at

the Company’s chicken-processing facility in Blountsville, Alabama.

The complaint does not contain a definite statement of what

acts constituted alleged violations of the statute, although the

Secretary of Labor has indicated in discovery that the case seeks to

require the Company to compensate all hourly chicken processing

workers for pre- and post-shift clothes changing, washing and

related activities and for one of two unpaid 30-minute meal

periods. The Secretary of Labor seeks unspecified back wages for

all employees at the Blountsville facility for a period of two years

prior to the date of the filing of the complaint, an additional

amount in unspecified liquidated damages, and an injunction

against future violations at that facility and all other chicken

processing facilities operated by the Company. Discovery is in

process. No trial date has been set. The matter has been stayed

pending the outcome of two other similar matters involving the

donning and doffing of certain personal protective clothing and

equipment before the U.S. Supreme Court Alvarez, et al. v. IBP

(Alvarez, see below) and Tum, et al. v. Barber Foods, Inc. (Tum). On

November 8, 2005, the U.S. Supreme Court affirmed the Ninth

Circuit decision in Alvarez and affirmed in part and reversed in

part the First Circuit decision in Tum. On November 18, 2005,

the Secretary of Labor filed a motion to lift the stay and set

a status conference. The Company has filed a response not

opposing the motion.

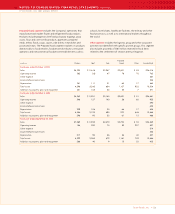

On June 22, 1999, 11 current and former employees of the Company

filed the case of M.H. Fox, et al. v. Tyson Foods, Inc. (Fox) in the U.S.

District Court for the Northern District of Alabama claiming the

Company violated requirements of the FLSA. The suit alleges the

Company failed to pay employees for all hours worked and/or

improperly paid them for overtime hours. The suit specifically

alleges that (1) employees should be paid for time taken to put on

and take off certain working supplies at the beginning and end of

their shifts and breaks and (2) the use of “mastercard” or “line” time

fails to pay employees for all time actually worked. Plaintiffs seek

to represent themselves and all similarly situated current and

former employees of the Company, and plaintiffs seek reimburse-

ment for an unspecified amount of unpaid wages, liquidated

damages, attorney fees and costs. To date, approximately 5,100

consents have been filed with the District Court. Plaintiff’s motion

for conditional collective treatment and court-supervised notice to

additional putative class members was denied on February 27, 2004.

The plaintiffs refiled their motion for conditional collective treat-

ment and court-supervised notice to additional putative class

members on April 2, 2004, and the District Court has not ruled

on this motion. Discovery is in process. No trial date has been set.

The matter has been stayed pending the outcome of Alvarez and

Tum. On November 8, 2005, the U.S. Supreme Court affirmed the

Ninth Circuit decision in Alvarez and affirmed in part and reversed

in part the First Circuit decision in Tum. On November 11, 2005,

Plaintiffs filed a motion to lift the stay and to set a status confer-

ence with the District Court. A status conference was scheduled

for December 14, 2005.