Tyson Foods 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

Tyson Foods, Inc. >> 38

other comprehensive income (loss) until the hedged item is recog-

nized in earnings. The effect of the derivatives and the hedged items

that are accounted for as a hedge, as defined by SFAS No. 133, are

recorded in cost of sales. The ineffective portion of an instrument’s

change in fair value will be immediately recognized in earnings as

a component of cost of sales. Instruments the Company holds as

part of its risk management activities that do not meet the criteria

for hedge accounting, as defined by SFAS No. 133, as amended,

are marked to fair value with unrealized gains or losses reported

currently in earnings. Changes in market value of derivatives used in

the Company's risk management activities surrounding inventories

on hand or anticipated purchases of inventories or supplies are

recorded in cost of sales. Changes in market value of derivatives

used in the Company's risk management activities surrounding

forward sales contracts are recorded in sales. The Company gener-

ally does not hedge anticipated transactions beyond 12 months.

Revenue Recognition: The Company recognizes revenue when title

and risk of loss are transferred to customers, which is generally

upon delivery based upon terms of sale. Revenue is recognized as

the net amount estimated to be received after deducting estimated

amounts for discounts, trade allowances and product terms.

Litigation Reserves: There are a variety of legal proceedings pending

or threatened against the Company. Accruals are recorded when

it is probable that a liability has been incurred and the amount of

the liability can be estimated reasonably based on current law,

progress of each case, opinions and views of legal counsel and other

advisers, the Company’s experience in similar matters and manage-

ment’s intended response to the litigation. These amounts, which

are not discounted and are exclusive of claims against third parties,

are adjusted periodically as assessment efforts progress or addi-

tional information becomes available. The Company expenses

amounts for administering or litigating claims as incurred. Accruals

for legal proceedings are included in other current liabilities in the

consolidated balance sheets.

Freight Expense: Freight expense associated with products shipped

to customers is recognized in cost of products sold.

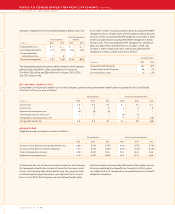

Advertising and Promotion Expenses: Advertising and promotion

expenses are charged to operations in the period incurred. Adver-

tising and promotion expenses for fiscal years 2005, 2004 and 2003

were $456 million, $465 million and $504 million, respectively.

Use of Estimates: The consolidated financial statements are pre-

pared in conformity with accounting principles generally accepted

in the United States, which require management to make estimates

and assumptions that affect the amounts reported in the consoli-

dated financial statements and accompanying notes. Actual results

could differ from those estimates.

Recently Issued Accounting Standards and Regulations: In

March 2005, the Financial Accounting Standards Board (FASB)

issued Interpretation No. 47, “Accounting for Conditional Asset

Retirement Obligations,” an interpretation of FASB Statement

No. 143 (the Interpretation). Statement of Financial Accounting

Standards No. 143, “Accounting for Asset Retirement Obligations”

(SFAS No. 143), was issued in June 2001 and requires an entity to

recognize the fair value of a liability for an asset retirement obliga-

tion in the period in which it is incurred if a reasonable estimate of

fair value can be made. SFAS No. 143 applies to legal obligations

associated with the retirement of a tangible long-lived asset that

resulted from the acquisition, construction, development and (or)

the normal operation of a long-lived asset. The associated asset

costs are capitalized as part of the carrying amount of the long-

lived asset. The Interpretation clarifies the term “conditional asset

retirement obligation” as used in SFAS No. 143, refers to a legal

obligation to perform an asset retirement activity in which the

timing and (or) method of settlement are conditional on a future

event that may or may not be within the control of the entity. The

Interpretation requires an entity to recognize a liability for the fair

value of a conditional asset retirement obligation if the fair value

of the liability can be reasonably estimated. Uncertainty about the

timing and (or) method of settlement of a conditional asset retire-

ment obligation should be factored into the measurement of the

liability when sufficient information exists. SFAS No. 143 acknowl-

edges that in some cases, sufficient information may not be

available to reasonably estimate the fair value of an asset retire-

ment obligation. The Interpretation is effective for fiscal years

ending after December 15, 2005. The Company is currently in the

process of evaluating any potential effects of the Interpretation

but does not believe its adoption will have a material impact on

its consolidated financial statements.

In December 2004, the FASB issued Statement of Financial Accounting

Standards No. 123R, “Share-Based Payment” (SFAS No. 123R), which

is a revision of FASB Statement No. 123, “Accounting for Stock-

Based Compensation” (SFAS No. 123). SFAS No. 123R supersedes

Accounting Principles Board (APB) Opinion No. 25, “Accounting for

Stock Issued to Employees,” and amends FASB Statement No. 95,

“Statement of Cash Flows.” The revision requires companies to

measure and recognize compensation expense for all share-based

payments to employees, including grants of employee stock options,

in the financial statements based on the fair value at the date of the

grant. SFAS No. 123R permits companies to adopt its requirements

using either the modified prospective method or the modified

retrospective method. Under the modified prospective method,

compensation cost is recognized beginning with the effective date