Tyson Foods 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 49

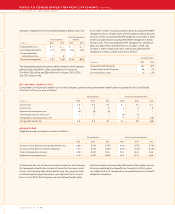

The Company has four postretirement health plans. Two of these

consist of fixed, annual payments by the Company and account

for $39 million of the Company’s postretirement obligation at

October 1, 2005. A healthcare cost trend is not required to deter-

mine this obligation. The remaining two plans, Pre-Medicare and

Post Medicare, account for $21 million of the Company’s post-

retirement medical obligation at year end. The Pre-Medicare plan

covers retirees who do not yet qualify for Medicare and uses a

healthcare cost trend of 11% in the current year, grading down to

6% in fiscal 2011. The Post Medicare plan provides secondary cover-

age to retirees covered under Medicare and has a healthcare cost

trend of 8% that grades down to 5% in fiscal 2009. Assumed health-

care cost trend rates would have the following effects:

One-Percentage- One-Percentage-

in millions Point Increase Point Decrease

Effect on total of service and interest cost $1 $1

Effect on postretirement benefit obligation 27 22

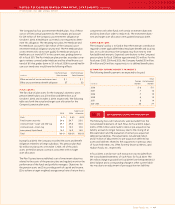

PLAN ASSETS

The fair value of plan assets for the Company’s domestic union

pension benefit plans was $70 million and $59 million as of

October 1, 2005, and October 2, 2004, respectively. The following

table sets forth the actual and target asset allocation for the

Company’s pension plan assets:

Target Asset

2005 2004 Allocation

Cash 0.7% 0.8% 0.0%

Fixed income securities 24.6 24.7 25.0

US Stock Funds—Large- and Mid-Cap 49.7 49.6 50.0

US Stock Funds—Small-Cap 10.0 10.0 10.0

International Stock Funds 15.0 14.9 15.0

Total 100.0% 100.0% 100.0%

During fiscal 2005, the Company recorded the assets and benefit

obligation related to a foreign subsidiary. This pension plan had

$12 million in plan assets at October 1, 2005. All of this plan’s

assets are held in annuity contracts consistent with its target

asset allocation.

The Plan Trustees have established a set of investment objectives

related to the assets of the pension plans and regularly monitor the

performance of the funds and portfolio managers. Objectives for

the pension assets are (1) to provide growth of capital and income,

(2) to achieve a target weighted average annual rate of return that is

competitive with other funds with similar investment objectives

and (3) to diversify in order to reduce risk. The investment objec-

tives and target asset allocation were updated in January 2004.

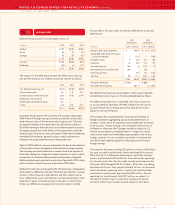

CONTRIBUTIONS

The Company’s policy is to fund at least the minimum contribution

required to meet applicable federal employee benefit and local tax

laws. In its sole discretion, the Company may from time to time

fund additional amounts. Expected contributions to the Company’s

pension plans for fiscal 2006 are approximately $10 million. For the

fiscal years 2005, 2004 and 2003, the Company funded $10 million,

$9 million and $4 million, respectively, to its defined benefit plans.

ESTIMATED FUTURE BENEFIT PAYMENTS

The following benefit payments are expected to be paid:

Other

Pension Postretirement

in millions Benefits Benefits

2006 $ 6 $11

2007 712

2008 712

2009 813

2010 814

2011–2015 55 77

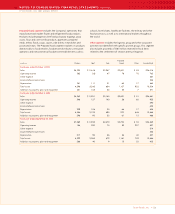

SUPPLEMENTAL CASH FLOW INFORMATION

>> 15

The following non-cash transactions were excluded from the

Consolidated Statements of Cash Flows for fiscal 2005. Adjust-

ments of $53 million were made to remove pre-acquisition tax

liability accruals no longer necessary due to the closing of an

IRS examination and the evaluation of certain pre-acquisition

deferred tax liabilities. The adjustments include $46 million

and $7 million of adjustments to pre-acquisition deferred tax

assets and liabilities related to the acquisitions in previous years

of Tyson Fresh Meats, Inc. (TFM; formerly known as IBP, inc.) and

Hudson Foods, Inc., respectively.

In fiscal 2004, a similar non-cash transaction was excluded from

the Consolidated Statements of Cash Flows for fiscal 2004. The

$91 million change in goodwill in fiscal 2004 from the September 27,

2003, balance and a corresponding change in other current liabili-

ties was due to an adjustment of pre-acquisition tax liabilities