Tyson Foods 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 39

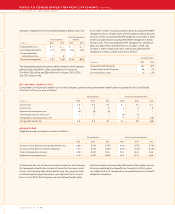

for all share-based payments granted after the effective date and

for all awards granted to employees prior to the effective date of

SFAS No. 123R that remain unvested on the effective date. The

modified retrospective method includes the requirements of

the modified prospective method, but also permits entities to

restate either all prior periods presented or prior interim periods

of the year of adoption for the impact of adopting this standard.

The Company will apply the modified prospective method upon

adoption. In April 2005, the Securities and Exchange Commission

announced it would provide for phased-in implementation of SFAS

No. 123R. As a result, SFAS No. 123R is effective for the first interim

or annual reporting period of the registrant’s first fiscal year begin-

ning on or after June 15, 2005. The Company estimates that com-

pensation expense related to employee stock options for fiscal 2006

is expected to be in the range of $10-$15 million. SFAS No. 123R

also requires the benefits of tax deductions in excess of recognized

compensation costs to be reported as financing cash flow, rather

than as an operating cash flow as required under current literature.

This requirement will reduce net operating cash flows and increase

net financing cash flows in periods after adoption. The Company

believes this reclass will not have a material impact on its

Consolidated Statements of Cash Flows.

In December 2004, the FASB issued Statement of Financial Account-

ing Standards No. 151, “Inventory Costs” (SFAS No. 151). SFAS No. 151

requires abnormal amounts of inventory costs related to idle facil-

ity, freight handling and wasted material expenses to be recognized

as current period charges. Additionally, SFAS No. 151 requires alloca-

tion of fixed production overheads to the costs of conversion be

based on the normal capacity of the production facilities. The stan-

dard is effective for fiscal years beginning after June 15, 2005. The

Company believes the adoption of SFAS No. 151 will not have a

material impact on its consolidated financial statements.

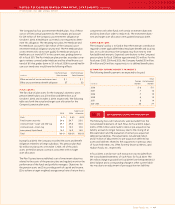

In October 2004, the President signed into law the American Jobs

Creation Act (the AJC Act). The AJC Act provides for the elimina-

tion of the Extraterritorial Income Exclusion (ETI) and allows for a

federal income tax deduction for a percentage of income earned

from certain domestic production activities. The Company’s domes-

tic, or U.S., production activities will qualify for the deduction.

Based on the effective date of this provision of the AJC Act, the

Company will be eligible for this deduction beginning in fiscal 2006.

This provision will be phased in from fiscal 2006 through fiscal 2011

and provides for a deduction of between 3% and 9% of qualifying

domestic production income over that period. Additionally, on

December 21, 2004, the FASB issued FASB Staff Position 109-1,

“Application of FASB Statement No. 109, Accounting for Income

Taxes (SFAS No. 109), to the Tax Deduction on Qualified Production

Activities Provided by the American Jobs Creation Act of 2004”

(FSP 109-1). FSP 109-1, which was effective upon issuance, states the

deduction under this provision of the AJC Act should be accounted

for as a special deduction in accordance with SFAS No. 109. The

Company has not yet quantified the impact that will be realized

from these provisions of the AJC Act.

The AJC Act also allows for an 85% dividends received deduction

on the repatriation of certain earnings of foreign subsidiaries. On

December 21, 2004, the FASB issued FASB Staff Position 109-2,

“Accounting and Disclosure Guidance for the Foreign Earnings

Repatriation Provision within the American Jobs Creation Act of

2004” (FSP 109-2). FSP 109-2, which was effective upon issuance,

allows companies time beyond the financial reporting period

of enactment to evaluate the effect of the AJC Act on its plan for

reinvestment or repatriation of foreign earnings for purposes of

applying SFAS No. 109. Additionally, FSP 109-2 provides guidance

regarding the required disclosures surrounding a company’s

reinvestment or repatriation of foreign earnings. Additionally,

the Internal Revenue Service issued three notices relating to the

repatriation, which clarify the provisions of the Act. The latest in

the series of notices was IRS Notice 2005-64, which was issued

during the fourth quarter of fiscal 2005. During fiscal 2005, the

Company repatriated foreign earnings using the provision of

the act as discussed in Note 17, “Income Taxes” of the Notes to

Consolidated Financial Statements.

In December 2003, the Medicare Prescription Drug, Improvement

and Modernization Act of 2003 (the Act) was signed. The Act

allows a possible subsidy to retirement health plan sponsors to

help offset the costs of participant prescription drug benefits. In

March 2004, the FASB issued Staff Position No. 106-2, “Accounting

and Disclosure Requirements Related to the Act” (the Position). The

Position was effective for interim or annual periods beginning after

June 15, 2004. The Position allowed plan sponsors to recognize or

defer recognizing the effects of the Act in its financial statements

until specific accounting guidance for this federal subsidy was

issued. In the fourth quarter of fiscal 2005, the Company concluded

the prescription drug benefits included in its postretirement medical

plan is actuarially equivalent to Medicare part D under the Act. In

accordance with FASB Staff Position 106-2, the Company decreased

its accumulated postretirement obligation and recognized an actu-

arial gain of approximately $55 million related to the present value

of all future subsidies expected to be received. This gain was more

than offset by actuarial losses primarily related to increased claims

costs, resulting in a net actuarial loss of approximately $9 million

from the Company’s postretirement health plan. It is the Company’s

policy to fully recognize experience gains and losses of its post-

retirement plans in the year in which they occur. There was no

effect on service or interest cost in the current period.