Tyson Foods 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

Tyson Foods, Inc. >> 40

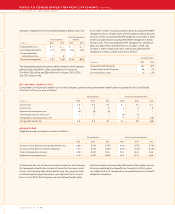

ACQUISITION

>> 02

In September 2003, the Company purchased Choctaw Maid Farms,

Inc. (Choctaw), an integrated poultry processor. Since 1992, Tyson

had been purchasing all of Choctaw’s production under a “cost

plus” supply agreement, which was scheduled to expire in 2007.

The Company previously had negotiated a purchase option with

Choctaw’s owners, which initially became exercisable in 2002. The

Company decided to exercise its purchase option rather than

continue under the “cost plus” arrangement of the supply agree-

ment. The acquisition was recorded as a purchase in accordance

with Statement of Financial Accounting Standards No. 141, “Business

Combinations.” Accordingly, the assets and liabilities were adjusted

for fair values with the remainder of the purchase price, $18 million,

recorded as goodwill. The purchase price consisted of $1 million cash

to exercise the purchase option in Tyson’s supply agreement with

Choctaw and settlement of $85 million owed to Tyson by Choctaw.

In addition, the Company assumed approximately $4 million of

Choctaw’s debt to a third party. In June 2003, the Company exercised

a $74 million purchase option to acquire assets leased from a third

party, which the Company had subleased to Choctaw. Pro forma

operating results reflecting the acquisition of Choctaw would not

be materially different from the Company’s actual results of opera-

tions. During fiscal 2004, goodwill was reduced $3 million due to

an adjustment of pre-acquisition liabilities assumed as part of the

Choctaw acquisition.

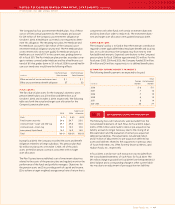

OTHER CHARGES

>> 03

In the fourth quarter of fiscal 2002, the Company recorded

$26 million of costs related to the restructuring of its live swine

operations that consisted of $21 million of estimated liabilities for

resolution of Company obligations under producer contracts and

$5 million of other related costs associated with this restructuring,

including lagoon and pit closure costs and employee termination

benefits. In the fourth quarter of 2004, the Company recorded an

additional reserve of $6 million related to lagoon and pit closure

costs. These amounts were reflected in the Company’s Pork segment

as a reduction of operating income and included in the Consoli-

dated Statements of Income in other charges. The Company is

accounting for the restructuring of its live swine operations in

accordance with Emerging Issues Task Force No. 94-3, “Liability

Recognition for Certain Employee Termination Benefits and Other

Costs to Exit an Activity” and Statement of Financial Accounting

Standards No. 144, “Accounting for the Impairment or Disposal

of Long-Lived Assets” (SFAS No. 144). In July 2005, the Company

announced it agreed to settle a lawsuit which resulted from

the restructuring of its live swine operations. The settlement

resulted in the Company recording an additional $33 million of costs

in the third quarter of fiscal 2005. As of October 1, 2005, $48 million

in payments to former producers and $13 million of other related

costs have been paid. No other material adjustments to the total

accrual are anticipated at this time.

In July 2005, the Company announced its decision to make

improvements to one of its Forest, Mississippi, facilities, which

will include more product lines, enabling the plant to increase

production of processed and marinated chicken. The Company

also will improve the plant’s roofing, flooring and refrigeration

systems. The improvements will be made at the former Choctaw

Maid Farms location, which the Company acquired in the fourth

quarter of fiscal 2003. When complete, the Company will close

the Cleveland Street Forest, Mississippi, poultry operation and

transfer production and employees to the newly upgraded facili-

ties. The Company expects to complete the project by the end

of the second quarter of fiscal 2006. The Cleveland Street Forest

operation currently employs approximately 900 people. As a result

of this decision, the Company recorded total costs of $9 million

for estimated impairment charges in fiscal 2005. This amount was

reflected in the Chicken segment as a reduction of operating

income and included in the Consolidated Statements of Income

in other charges. The Company is accounting for the closing of

the Cleveland Street Forest operation in accordance with SFAS

No. 144 and Statement of Financial Accounting Standards No. 146,

“Accounting for Costs Associated with Exit or Disposal Activities”

(SFAS No. 146). No other material adjustments to the total accrual

are anticipated at this time.

In July 2005, the Company announced its decision to close its

Bentonville, Arkansas, facility. The Bentonville operation employed

approximately 320 people and produced raw and partially fried

breaded chicken tenders, fillets, livers and gizzards. The plant

ceased operations in November 2005. The production from this

facility was transferred to the Company’s Russellville, Arkansas,

poultry plant, where an expansion enabled the facility to absorb

the Bentonville facility’s production. As a result of this decision,

the Company recorded total costs of $1 million for estimated

impairment charges and $1 million for employee termination

benefits in fiscal 2005. These amounts were reflected in the

Chicken segment as a reduction of operating income and

included in the Consolidated Statements of Income in other

charges. The Company is accounting for the closing of the

Bentonville operation in accordance with SFAS No. 144 and

SFAS No. 146. As of October 1, 2005, no employee termination

benefits had been paid. No other material adjustments to the

total accrual are anticipated at this time.