Tyson Foods 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 45

through various recourse provisions and an undeterminable recov-

erable amount based on the fair market value of the underlying

leased assets. The likelihood of payments under these guarantees is

not considered probable. At October 1, 2005, and October 2, 2004,

no liabilities for guarantees were recorded.

Additionally, the Company also enters into future purchase

commitments for various items such as corn, soybeans, livestock

and natural gas contracts. At October 1, 2005, these commitments

totaled $338 million, composed of $313 million for fiscal 2006,

$15 million for fiscal 2007, $2 million for fiscal 2008, $2 million for

fiscal 2009, $2 million for fiscal 2010 and $4 million for later years.

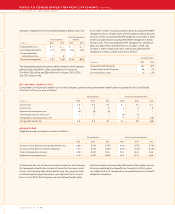

LONG-TERM DEBT

>> 10

The Company has an unsecured revolving credit facility totaling

$1.0 billion that support the Company’s commercial paper program,

letters of credit and other short-term funding needs. During the

fourth quarter of fiscal 2005, the Company restructured its revolving

credit facilities into one facility, which now consists of $1.0 billion

that expires in September 2010. At October 1, 2005, the Company had

outstanding letters of credit totaling approximately $254 million

issued primarily in support of workers’ compensation insurance

programs and derivative activities. There were no draw downs

under these letters of credit at October 1, 2005. At October 1, 2005,

and October 2, 2004, there were no amounts drawn under the

revolving credit facilities; however, the outstanding letters of credit

reduce the amount available under the revolving credit facilities.

The Company has a receivables purchase agreement with three

co-purchasers to sell up to $750 million of trade receivables.

These agreements were restructured and extended in the fourth

quarter of fiscal 2005 and now consist of $375 million expiring in

August 2006, and $375 million expiring in August 2008. The receiv-

ables purchase agreement has been accounted for as a borrowing

and has an interest rate based on commercial paper issued by the

co-purchasers. Under this agreement, substantially all of the

Company’s accounts receivable are sold to a special purpose

entity, Tyson Receivables Corporation (TRC), which is a wholly-

owned consolidated subsidiary of the Company. TRC has its own

separate creditors that are entitled to be satisfied out of all of

the assets of TRC prior to any value becoming available to the

Company as TRC’s equity holder. At October 1, 2005, there were

no amounts drawn under the receivables purchase agreement

while at October 2, 2004, there was $150 million outstanding under

the receivables purchase agreement expiring in August 2005 and

$150 million under the agreement expiring in August 2007.

In September 2005, Lakeside Farm Industries, Ltd. (Lakeside) borrowed

$353 million in U.S. dollars under a new unsecured three-year term

agreement with the principal balance being due at the end of

the term. The agreement provides for interest rates ranging from

LIBOR plus 0.4 percent to LIBOR plus one percent depending on

the Company’s debt rating. Interest payments are made at least

quarterly. Lakeside is a wholly-owned subsidiary of the Company.

Under the terms of the leveraged equipment loans, the Company

had cash deposits totaling approximately $52 million and $57 million,

which was included on the Consolidated Balance Sheets in other

assets at October 1, 2005 and October 2, 2004. Under these lever-

aged loan agreements, the Company entered into interest rate

swap agreements to effectively lock in a fixed interest rate for

these borrowings.

Annual maturities of long-term debt for the five fiscal years

subsequent to October 1, 2005, are: 2006 – $126 million;

2007 – $898 million; 2008 – $14 million; 2009 – $358 million;

2010 – $237 million.

The revolving credit facility, senior notes, notes and accounts

receivable securitization contain various covenants, the more

restrictive of which contain a maximum allowed leverage ratio

and a minimum required interest coverage ratio. The Company

was in compliance with all of such covenants at fiscal year end.

Long-term debt consists of the following:

in millions Maturity 2005 2004

Commercial paper

(2.05% effective rate at 10/2/04) Various $–$86

Revolving Credit Facilities 2010 ––

Senior notes and Notes (rates ranging

from 6.13% to 8.25%) 2006–2028 2,529 2,816

Term Loan (4.44% effective rate

at 10/1/05) 2008 345 –

Accounts Receivable Securitization

(2.51% effective rate at 10/2/04) 2006, 2008 – 300

Institutional notes

(10.84% effective rate at 10/1/05

and 10/2/04) 2006 10 20

Leveraged equipment loans (rates

ranging from 4.67% to 5.99%) 2006–2009 64 85

Other Various 47 55

Total debt 2,995 3,362

Less current debt 126 338

Total long-term debt $2,869 $3,024

The Company has fully and unconditionally guaranteed

$476 million of senior notes issued by Tyson Fresh Meats, Inc.

(TFM; formerly known as IBP, inc.), a wholly-owned subsidiary of

the Company. Additionally, the Company has fully and uncondi-

tionally guaranteed $345 million related to a term loan facility

borrowed by Lakeside.