Tyson Foods 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 37

Accrued Self Insurance: The Company uses a combination of insur-

ance and self-insurance mechanisms to provide for the potential

liabilities for health and welfare, workers’ compensation, auto

liability and general liability risks. Liabilities associated with the

risks that are retained by the Company are estimated, in part, by

considering historical claims experience, demographic factors,

severity factors and other actuarial assumptions.

Capital Stock: The Company has two classes of capital stock,

Class A common stock (Class A stock) and Class B common stock

(Class B stock). Holders of Class B stock may convert such stock into

Class A stock on a share-for-share basis. Holders of Class B stock are

entitled to 10 votes per share while holders of Class A stock are

entitled to one vote per share on matters submitted to share-

holders for approval. Cash dividends cannot be paid to holders

of Class B stock unless they are simultaneously paid to holders of

Class A stock. The per share amount of the cash dividend paid to

holders of Class B stock cannot exceed 90% of the cash dividend

simultaneously paid to holders of Class A stock. The Company pays

quarterly cash dividends to Class A and Class B shareholders. The

Company paid Class A dividends per share of $0.16 and Class B divi-

dends per share of $0.144 in fiscal years 2005, 2004 and 2003.

According to the Emerging Issues Task Force Issue No. 03-6,

“Participating Securities and the Two-Class Method under FASB

Statement No. 128, Earnings per Share” (EITF Issue No. 03-6), the

Class B stock is considered a participating security requiring the use

of the two-class method for the computation of basic earnings per

share. The two-class computation method for each period reflects

the cash dividends paid per share for each class of stock, plus the

amount of allocated undistributed earnings per share computed

using the participation percentage which reflects the dividend

rights of each class of stock. Basic earnings per share reflect the

application of EITF Issue No. 03-6 and was computed using the two-

class method for all periods presented. The shares of Class B stock

are considered to be participating convertible securities since the

shares of Class B stock are convertible on a share-for-share basis

into shares of Class A stock. Diluted earnings per share have been

computed assuming the conversion of the Class B shares into

Class A shares as of the beginning of each period.

Stock Compensation: On December 29, 2002, the Company adopted

Statement of Financial Accounting Standards No. 148, “Accounting

for Stock-Based Compensation –Transition and Disclosure”

(SFAS No. 148). SFAS No. 148, which amended Financial Accounting

Standards Board (FASB) Statement No. 123, “Accounting for Stock-

Based Compensation,” does not require use of the fair value

method of accounting for stock-based employee compensation.

The Company applies Accounting Principles Board Opinion No. 25

and related interpretations in accounting for its employee stock

compensation plans. Accordingly, no compensation expense was

recognized for its stock option issuances as stock options are

issued with an exercise price equal to the closing price at the date

of the grant. The Company does issue restricted stock and records

the fair value of such awards as deferred compensation amortized

over the vesting period. Had compensation expense for the

employee stock compensation plans been determined based on

the fair value method of accounting for the Company’s stock

compensation plans, the tax-effected impact would be as follows:

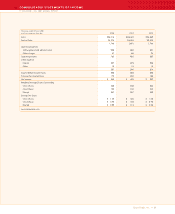

in millions, except per share data 2005 2004 2003

Net income, as reported $ 353 $ 403 $ 337

Stock-based employee compensation

expense included in net income,

net of tax 16 10 10

Total stock-based employee

compensation expense determined

under fair value based method for

all awards, net of tax (23) (16) (14)

Pro forma net income $ 346 $ 397 $ 333

Earnings per share

As reported

Class A Basic $1.05 $1.20 $1.00

Class B Basic $0.95 $1.08 $0.90

Diluted $0.99 $1.13 $0.96

Pro forma

Class A Basic $1.03 $1.18 $0.99

Class B Basic $0.93 $1.06 $0.89

Diluted $0.97 $1.11 $0.95

The pro forma disclosures may not be representative of the effects

on net income for future years.

Financial Instruments: The Company is a purchaser of certain

commodities, such as corn, soybeans, livestock and natural gas in

the course of normal operations. The Company uses derivative

financial instruments to reduce its exposure to various market risks.

Generally, contract terms of a hedge instrument closely mirror

those of the hedged item, providing a high degree of risk reduction

and correlation. Contracts that are designated and highly effective

at meeting the risk reduction and correlation criteria are recorded

using hedge accounting, as defined by Statement of Financial

Accounting Standards No. 133, “Accounting for Derivative Instruments

and Hedging Activities” (SFAS No. 133), as amended. If a derivative

instrument is a hedge, as defined by SFAS No. 133, depending on the

nature of the hedge, changes in the fair value of the instrument will

either be offset against the change in fair value of the hedged assets,

liabilities or firm commitments through earnings or recognized in