Tyson Foods 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

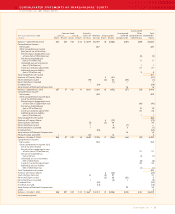

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

Tyson Foods, Inc. >> 36

Goodwill and Other Intangible Assets: Goodwill and indefinite life

intangible assets are initially recorded at fair value and not amor-

tized, but are reviewed for impairment at least annually or more

frequently if impairment indicators arise, as required by Statement

of Financial Accounting Standards No. 142, “Goodwill and Other

Intangible Assets” (SFAS No. 142). In the Company’s assessment of

goodwill, management makes assumptions by segment regarding

estimated future cash flows and other factors to determine the fair

value of the respective assets. The fair value of the Company’s

trademarks is determined using a royalty rate method based on

expected revenues by trademark. Goodwill has been allocated to

and tested for impairment by reporting unit based on fair value of

identifiable assets. This goodwill is not deductible for income tax

purposes. At October 1, 2005, and October 2, 2004, the accumu-

lated amortization of goodwill was $286 million.

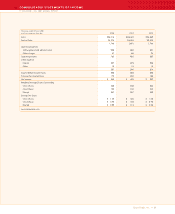

Amount of goodwill by segment at October 1, 2005, and

October 2, 2004, was as follows:

in millions 2005 2004

Chicken $ 922 $ 933

Beef 1,199 1,235

Pork 321 330

Prepared Foods 60 60

Total $2,502 $2,558

The reduction in the goodwill balance is primarily due to adjustments

of $53 million related to pre-acquisition tax liability accruals that

were no longer necessary due to the closing of an IRS examination

and the evaluation of certain pre-acquisition deferred tax liabilities.

The adjustments include $46 million and $7 million of deferred tax

asset and liability adjustments related to the acquisitions in previ-

ous years of Tyson Fresh Meats, Inc. (TFM; formerly known as IBP, inc.)

and Hudson Foods, Inc., respectively.

At October 1, 2005, the gross carrying value of intangible assets

consisted of $76 million of trademarks, $85 million of patents and

$11 million of supply contracts with accumulated amortization of

$20 million and $10 million for patents and supply contracts,

respectively. At October 2, 2004, the gross carrying value of intan-

gible assets consisted of $80 million of trademarks, $85 million

of patents and $11 million of supply contracts with accumulated

amortization of $19 million and $8 million for patents and supply

contracts, respectively. The reduction in the carrying value of

intangible assets in fiscal 2005 as compared to the prior year

resulted from a $4 million impairment of trademarks. Amortization

expense on combined patents and supply contracts of $3 million

was recognized during fiscal 2005, and $8 million was recognized

during fiscal years 2004 and 2003. Amortization expense on intan-

gible assets is estimated to be $3 million for fiscal years 2006 and

2007, $4 million in fiscal year 2008, $5 million in fiscal year 2009

and $6 million in fiscal year 2010. Patents and supply contracts

are amortized using the straight-line method over their estimated

period of benefit of five to 15 years, beginning with the date the

benefits from intangible items are realized.

In fiscal 2004, the Company recorded charges of approximately

$25 million related to the impairment of various intangible assets,

of which $22 million was recorded in the Prepared Foods segment

and $3 million was recorded in the Beef segment. The impairment

charges apply primarily to trademarks acquired in the acquisition

of TFM in 2001. These impairment charges were included in other

charges on the Company’s Consolidated Statements of Income and

resulted primarily from lower product sales under some of the

Company’s regional trademarks as products are increasingly being

sold under the Tyson trademark.

Investments: The Company has investments in joint ventures and

other entities. The Company typically uses the cost method of

accounting where its voting interests are less than 20 percent,

and the equity method of accounting where its voting interests

are in excess of 20 percent but not greater than 50 percent. The

Company’s underlying share of each entity’s equity is reported in

the Consolidated Balance Sheets in the line item other assets.

At October 1, 2005, the Company had $138 million of marketable

debt securities. Of this amount, $5 million were due in one year or

less and were classified in other current assets in the Consolidated

Balance Sheets, and $133 million were classified in other assets in

the Consolidated Balance Sheets, with maturities ranging from

one to 30 years. The Company has applied Statement of Financial

Accounting Standards No. 115, “Accounting for Certain Investments

in Debt and Equity Securities” (SFAS No. 115), and has determined all

of its marketable debt securities are available-for-sale investments.

These investments are reported at fair value based on quoted

market prices as of the balance sheet date, with unrealized gains

and losses, net of tax, recorded in other comprehensive income.

The amortized cost of debt securities is adjusted for amortization

of premiums and accretion of discounts to maturity. Such amortiza-

tion is recorded in interest income. The cost of securities sold is

based on the specific identification method. Realized gains and

losses on the sale of debt securities and declines in value judged

to be other than temporary are recorded on a net basis in other

income. Interest and dividends on securities classified as available-

for-sale are recorded in interest income.