Tyson Foods 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> MANAGEMENT’S DISCUSSION AND ANALYSIS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 29

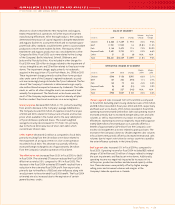

CAUTIONARY STATEMENTS RELEVANT

TO FORWARD-LOOKING INFORMATION FOR

THE PURPOSE OF “SAFE HARBOR”

PROVISIONS OF THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

This report and other written reports and oral statements, made

from time to time by the Company and its representatives, contain

forward-looking statements with respect to their current views and

estimates of future economic circumstances, industry conditions,

Company performance and financial results, including, without

limitation, debt-levels, return on invested capital, value-added

product growth, capital expenditures, tax rates, access to foreign

markets and dividend policy. These forward-looking statements are

subject to a number of factors and uncertainties that could cause

the Company’s actual results and experiences to differ materially

from the anticipated results and expectations expressed in such

forward-looking statements. The Company wishes to caution

readers not to place undue reliance on any forward-looking state-

ments, which speak only as of the date made. Tyson undertakes

no obligation to publicly update any forward-looking statements,

whether as a result of new information, future events or otherwise.

Among the factors that may cause actual results and experiences to

differ from the anticipated results and expectations expressed in

such forward-looking statements are the following: (i) fluctuations

in the cost and availability of raw materials, such as live cattle, live

swine or feed grains; (ii) market conditions for finished products,

including the supply and pricing of alternative proteins, and the

demand for alternative proteins; (iii) risks associated with effec-

tively evaluating derivatives and hedging activities; (iv) access to

foreign markets together with foreign economic conditions,

including currency fluctuations and import/export restrictions;

(v) outbreak of a livestock disease (such as avian influenza (AI) or

bovine spongiform encephalopathy (BSE)) which could have an

effect on livestock owned by the Company, the availability of live-

stock for purchase by the Company, consumer perception of certain

protein products or the Company’s ability to access certain markets;

(vi) successful rationalization of existing facilities, and the operating

efficiencies of the facilities; (vii) changes in the availability and rela-

tive costs of labor and contract growers; (viii) issues related to food

safety, including costs resulting from product recalls, regulatory

compliance and any related claims or litigation; (ix) adverse results

from litigation; (x) risks associated with leverage, including cost

increases due to rising interest rates or changes in debt ratings or

outlook; (xi) changes in regulations and laws (both domestic and

foreign), including changes in accounting standards, environmental

laws and occupational, health and safety laws; (xii) the ability of the

Company to make effective acquisitions and successfully integrate

newly acquired businesses into existing operations; (xiii) effective-

ness of advertising and marketing programs; and (xiv) the effect of,

or changes in, general economic conditions.

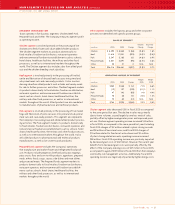

QUANTITATIVE AND QUALITATIVE

DISCLOSURE ABOUT MARKET RISKS

MARKET RISKS

Market risks relating to the Company’s operations result primarily

from changes in commodity prices, interest rates and foreign

exchange rates, as well as credit risk concentrations. To address

certain of these risks, the Company enters into various derivative

transactions as described below. If a derivative instrument is a

hedge, as defined by SFAS No. 133, as amended, depending on the

nature of the hedge, changes in the fair value of the instrument

will be either offset against the change in fair value of the hedged

assets, liabilities or firm commitments through earnings, or recog-

nized in other comprehensive income (loss) until the hedged item

is recognized in earnings. The ineffective portion of an instrument’s

change in fair value, as defined by SFAS No. 133, as amended, will be

immediately recognized in earnings as a component of cost of

sales. Additionally, the Company holds certain positions, primarily

in grain and livestock futures, which do not meet the criteria for

SFAS No. 133 hedge accounting. These positions are marked to fair

value and the unrealized gains and losses are reported in earnings

at each reporting date. The changes in market value of derivatives

used in the Company’s risk management activities surrounding inven-

tories on hand or anticipated purchases of inventories are recorded

in cost of sales. The changes in market value of derivatives used in

the Company’s risk management activities surrounding forward

sales contracts are recorded in sales.

The sensitivity analyses presented below are the measures of

potential losses of fair value resulting from hypothetical changes

in market prices related to commodities. Sensitivity analyses do

not consider the actions management may take to mitigate the

Company’s exposure to changes, nor do they consider the effects

that such hypothetical adverse changes may have on overall

economic activity. Actual changes in market prices may differ

from hypothetical changes.