Tyson Foods 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 51

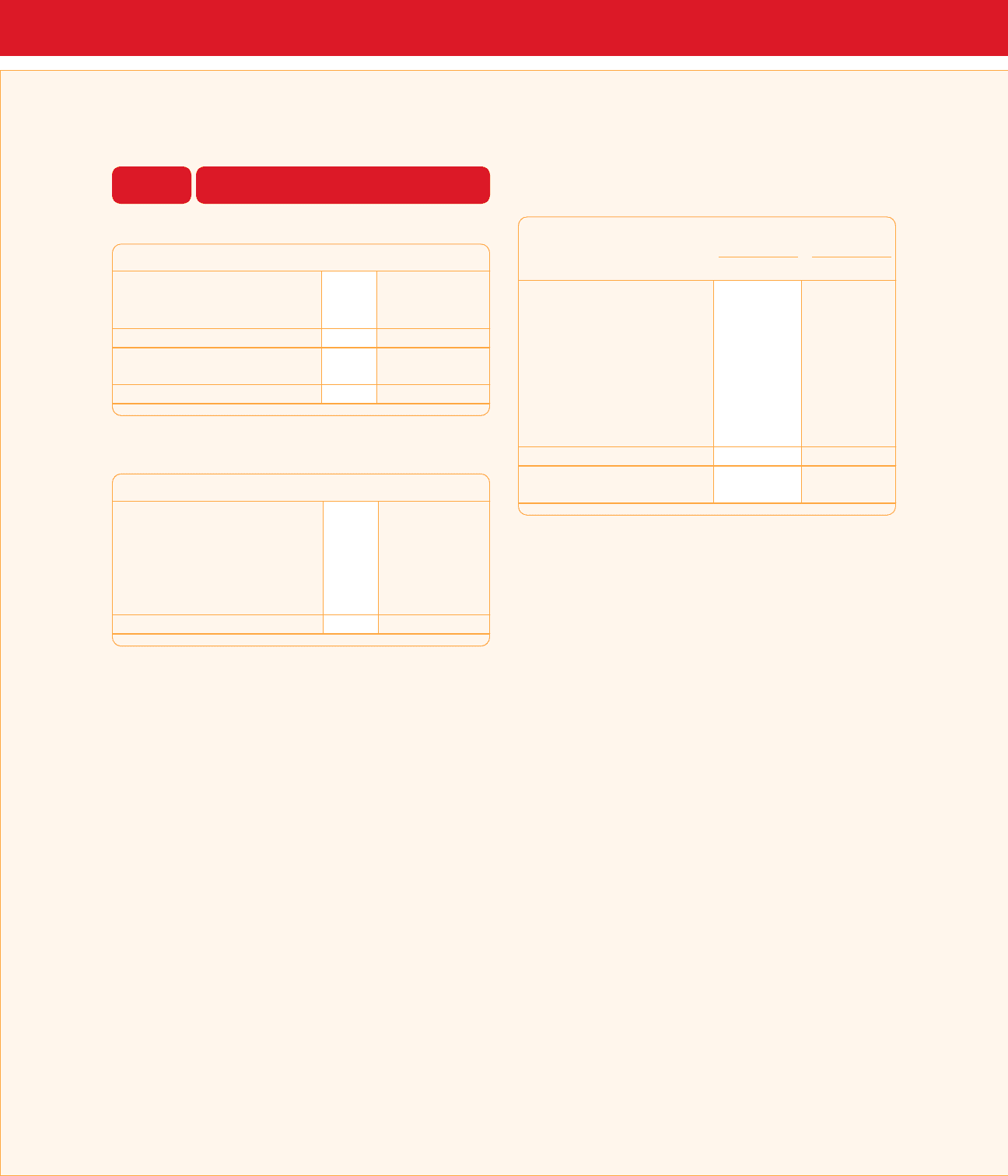

INCOME TAXES

>> 17

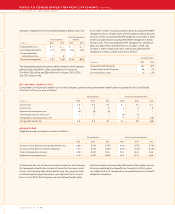

Detail of the provision for income taxes consists of:

in millions 2005 2004 2003

Federal $137 $183 $156

State 16 12 10

Foreign 22 37 20

$175 $232 $186

Current $249 $224 $73

Deferred (74) 8 113

$175 $232 $186

The reasons for the difference between the effective income tax

rate and the statutory U.S. federal income tax rate are as follows:

2005 2004 2003

U.S. federal income tax rate 35.0% 35.0% 35.0%

State income taxes 1.8 1.8 2.2

Extraterritorial income exclusion (2.6) (0.5) (1.9)

Reduction of tax reserves (4.1) – –

Repatriation of foreign earnings 4.2 – –

Other (1.2) 0.3 0.2

33.1% 36.6% 35.5%

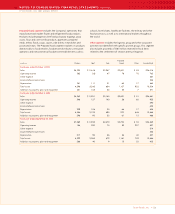

During the fourth quarter of fiscal 2005, the Company repatriated

$404 million of foreign earnings invested outside the United States

under the provisions of the American Jobs Creations Act. The total

tax expense relating to the repatriation was $22 million, offset by

$15 million relating to the reversal of certain international tax reserves

no longer required due to the effects of the repatriation under the

American Jobs Creation Act. Items included in Other are miscellaneous

nondeductible expenses, general business credits and amounts

relating to on-going examinations by taxing authorities.

The fiscal 2005 effective rate was reduced by 4.1% due to the reduction

of income tax reserves management deemed were no longer required.

The Company recorded a reduction to current income tax expense of

$22 million relating to a change of estimate of reserves for years in which

examinations by the Internal Revenue Service have been completed.

Additional adjustments resulted in a reduction of goodwill of $27 million

and an increase in capital in excess of par value of $25 million.

Deferred income taxes are recognized for the future tax consequences

attributable to differences between the financial statement carrying

amounts of existing assets and liabilities and their respective tax

basis. Deferred tax assets and liabilities are measured using tax rates

expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled.

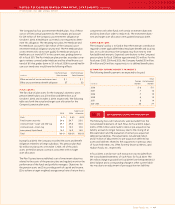

The tax effects of major items recorded as deferred tax assets and

liabilities are:

2005 2004

Deferred Tax Deferred Tax

in millions Assets Liabilities Assets Liabilities

Property, plant and equipment $ – $489 $ 4 $ 513

Suspended taxes from conversion

to accrual method – 125 – 138

Intangible assets 9253124

Inventory 10 89 12 77

Accrued expenses 108 6 114 4

Net operating loss carryforwards 123 – 83 –

International items –6518104

All other 90 110 103 148

$ 340 $909 $365 $1,008

Valuation allowance $(102) $ (66)

Net deferred tax liability $671 $ 709

Net deferred tax liabilities are included in other current liabilities

and deferred income taxes on the Consolidated Balance Sheets.

The deferred tax liability for suspended taxes from conversion

to accrual method represents the 1987 change from the cash to

accrual method of accounting and will be paid down by 2017,

subject to certain limitations.

The Company has accumulated but undistributed earnings of

foreign subsidiaries aggregating approximately $161 million at

October 1, 2005, which are expected to be indefinitely reinvested

in the business. If those earnings were distributed in the form of

dividends or otherwise, the Company would be subject to U.S.

income taxes (subject to an adjustment for foreign tax credits),

state income taxes and withholding taxes payable to the various

foreign countries. It is not currently practicable to estimate the

tax liability that might be payable on the repatriation of these

foreign earnings.

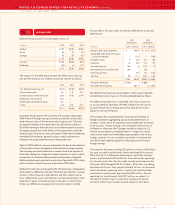

The valuation allowance totaling $102 million consists of $16 million

for state tax credit carryforwards, which have been fully reserved,

$78 million for U.S. federal net operating loss and other miscella-

neous carryforwards and $8 million for international net operating

loss carryforwards. The state tax credit carryforwards expire in the

fiscal years 2006 through 2009. At October 1, 2005, after considering

utilization restrictions, the Company’s federal tax loss carryforwards,

which include net operating losses, capital losses and charitable

contribution carryforwards, approximated $241 million. The net

operating loss carryforwards total $217 million, are subject to

utilization limitations due to ownership changes and may be

utilized to offset future taxable income subject to limitations.