Tyson Foods 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>>

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 33

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

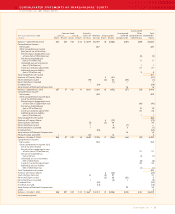

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Accumulated

Common Stock Capital in Unamortized Other Total

Three years ended October 1, 2005 Class A Class B Excess of Retained Treasury Stock Deferred Comprehensive Shareholders’

in millions Shares Amount Shares Amount Par Value Earnings Shares Amount Compensation Income (Loss) Equity

Balance – September 28, 2002 267 $27 102 $10 $1,879 $2,097 16 $(265) $(37) $(49) $3,662

Comprehensive Income:

Net income 337 337

Other comprehensive income

(loss) net of tax of $8 million

Derivative gain recognized in cost

of sales (net of $(1) million tax) (2) (2)

Derivative unrealized gain

(net of $7 million tax) 11 11

Unrealized gain on investments

(net of $1 million tax) 11

Currency translation adjustment 21 21

Additional pension liability

(net of $2 million tax) 33

Total Comprehensive Income 371

Purchase of Treasury Shares 4 (41) (41)

Restricted Shares Issued (19) (4) 55 (37) (1)

Restricted Shares Canceled 1(1)1 1

Dividends Paid (54) (54)

Amortization of Deferred Compensation 16 16

Balance – September 27, 2003 267 27 102 10 1,861 2,380 16 (252) (57) (15) 3,954

Comprehensive Income:

Net income 403 403

Other comprehensive income (loss)

net of tax of $(13) million

Derivative gain recognized in cost

of sales (net of $(26) million tax) (40) (40)

Derivative unrealized gain

(net of $12 million tax) 19 19

Currency translation adjustment 23 23

Additional pension liability

(net of $1 million tax) 11

Total Comprehensive Income 406

Purchase of Treasury Shares 4 (72) (72)

Stock Options Exercised (2) (3) 44 42

Restricted Shares Issued 16(7) —

Restricted Shares Canceled 1 (4) 2 (1)

Dividends Paid (55) (55)

Amortization of Deferred Compensation 16 16

Reclassification and Other 1 (12) 14 2

Balance – October 2, 2004 268 27 102 10 1,849 2,728 17 (264) (46) (12) 4,292

Comprehensive Income:

Net income 353 353

Other comprehensive income (loss)

net of tax of $11 million

Derivative loss recognized in cost

of sales (net of $13 million tax) 21 21

Derivative unrealized loss

(net of $0 tax) (1) (1)

Unrealized loss on investments

(net of $(1) million) (2) (2)

Currency translation adjustment 23 23

Additional pension liability

(net of $(1) million tax) (1) (1)

Total Comprehensive Income 393

Purchase of Treasury Shares 3 (45) (45)

Stock Options Exercised 14 (3) 37 51

Restricted Shares Issued (2) 38 (35) 3

Restricted Shares Canceled 1 (4) 1 (2)

Dividends Paid (55) (55)

Dividends Accrued (13) (13)

Amortization of Deferred Compensation 25 25

Other 3 3

Balance – October 1, 2005 268 $27 102 $10 $1,867 $3,013 15 $(238) $(55) $ 28 $4,652

See accompanying notes.

>>