Tyson Foods 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

Tyson Foods, Inc. >> 44

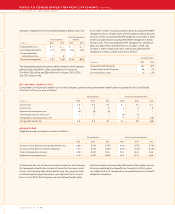

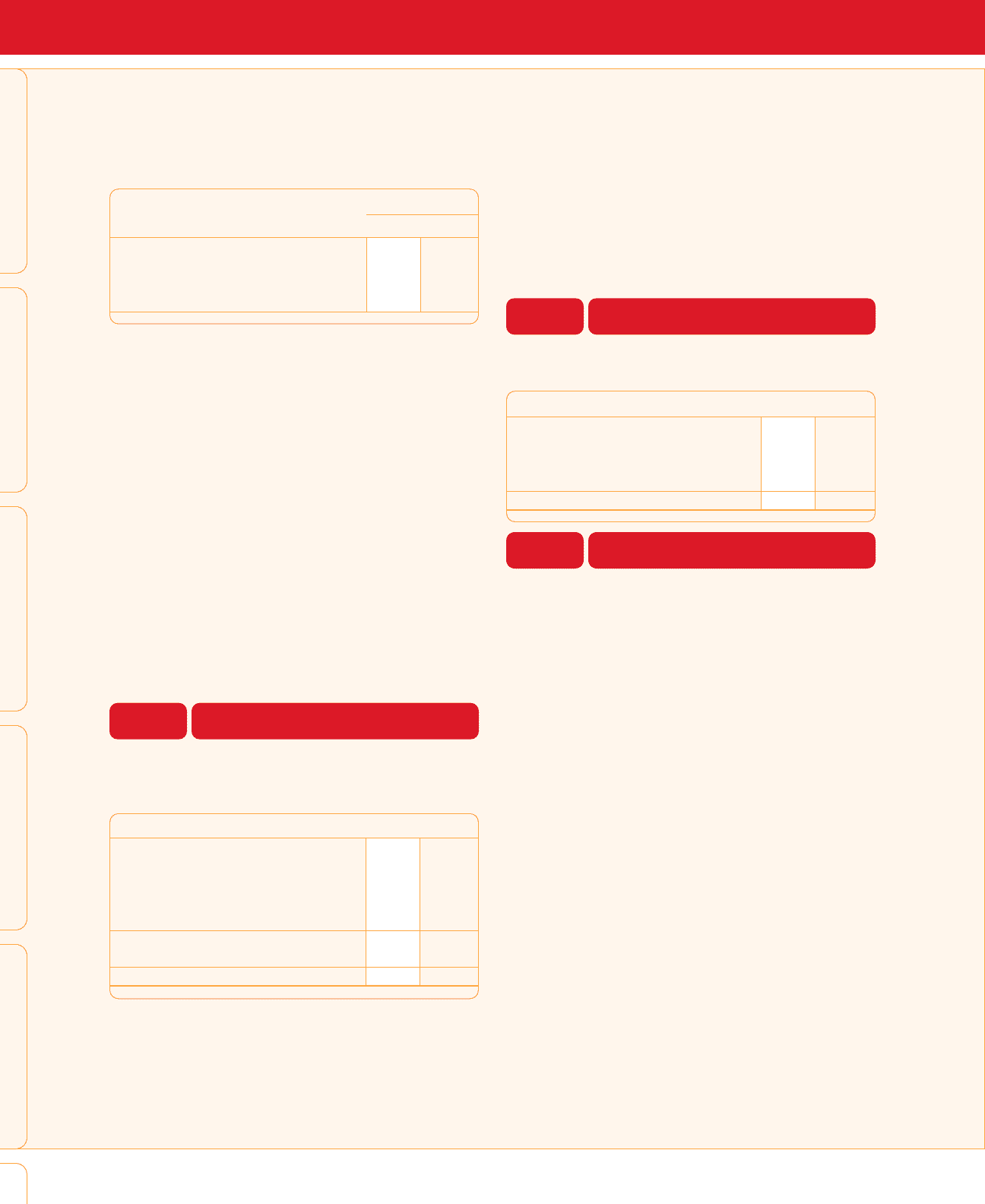

FAIR VALUES OF FINANCIAL INSTRUMENTS:

Asset (Liability)

in millions 2005 2004

Commodity derivative positions $ (7) $ 5

Interest-rate derivative positions (1) (1)

Total debt (3,232) (3,700)

Fair values are based on quoted market prices or published

forward interest rate and natural gas curves. Carrying values for

derivative positions equal the fair values as of October 1, 2005,

and October 2, 2004, and the carrying values of total debt was

$3.0 billion and $3.4 billion, respectively. All other financial instru-

ments’ fair values approximate recorded values at October 1, 2005,

and October 2, 2004.

Concentrations of Credit Risk: The Company’s financial instruments

that are exposed to concentrations of credit risk consist primarily

of cash equivalents and trade receivables. The Company’s cash

equivalents are in high quality securities placed with major banks

and financial institutions. Concentrations of credit risk with respect

to receivables are limited due to the large number of customers

and their dispersion across geographic areas. The Company performs

periodic credit evaluations of its customers’ financial condition

and generally does not require collateral. At October 1, 2005, and

October 2, 2004, approximately 13.0% and 15.0%, respectively, of

the Company’s net accounts receivable balance was due from one

customer. No other single customer or customer group represents

greater than 10% of net accounts receivable.

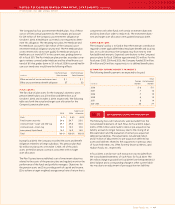

PROPERTY, PLANT AND EQUIPMENT

>> 07

The major categories of property, plant and equipment and

accumulated depreciation at cost, at October 1, 2005, and

October 2, 2004, are as follows:

in millions 2005 2004

Land $ 113 $ 111

Building and leasehold improvements 2,339 2,307

Machinery and equipment 4,015 3,981

Land improvements and other 195 194

Buildings and equipment under construction 407 218

7,069 6,811

Less accumulated depreciation 3,062 2,847

Net property, plant and equipment $4,007 $3,964

The Company’s total depreciation expense was $465 million,

$458 million and $427 million in fiscal years 2005, 2004 and 2003,

respectively. The Company capitalized interest costs of $6 million

in fiscal 2005 and $3 million in both fiscal years 2004 and 2003, as

part of the cost of major asset construction projects. Approximately

$521 million will be required to complete construction projects in

progress at October 1, 2005.

OTHER CURRENT LIABILITIES

>> 08

Other current liabilities at October 1, 2005, and October 2, 2004,

include:

in millions 2005 2004

Accrued salaries, wages and benefits $ 269 $ 270

Self-insurance reserves 252 248

Income taxes payable 183 149

Other 366 343

Total other current liabilities $1,070 $1,010

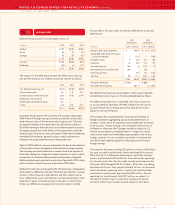

COMMITMENTS

>> 09

The Company leases equipment, properties and certain farms

for which the total rentals thereon approximated $116 million in

fiscal 2005, $111 million in fiscal 2004 and $104 million in fiscal 2003.

Most leases have terms ranging from one to seven years with vary-

ing renewal periods. The most significant obligations assumed

under the terms of the leases are the upkeep of the facilities

and payments of insurance and property taxes.

Minimum lease commitments under non-cancelable leases at

October 1, 2005, totaled $187 million composed of $82 million for

fiscal 2006, $48 million for fiscal 2007, $30 million for fiscal 2008,

$16 million for fiscal 2009, $5 million for fiscal 2010 and $6 million

for later years.

The Company guarantees debt of outside third parties, which involve

a lease and grower loans, all of which are substantially collateral-

ized by the underlying assets. Terms of the underlying debt range from

three to 10 years and the maximum potential amount of future pay-

ments as of October 1, 2005, was $87 million. The Company also

maintains operating leases for various types of equipment, some

of which contain residual value guarantees for the market value of

assets at the end of the term of the lease. The terms of the lease

maturities range from one to seven years. The maximum potential

amount of the residual value guarantees is approximately $106 mil-

lion, of which approximately $22 million would be recoverable