Tyson Foods 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

Tyson Foods, Inc. >> 50

assumed as part of the TFM acquisition. The Company received

formal approval during fiscal 2004 from The Joint Committee

on Taxation of the U.S. Congress for issues relating to certain

pre-acquisition years. As a result of this approval, the accrual of

$91 million of pre-acquisition tax liability was no longer needed.

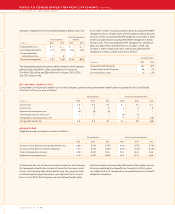

The following table summarizes cash payments for interest and

income taxes:

in millions 2005 2004 2003

Interest $218 $316 $269

Income taxes, net of refunds 107 244 36

Cash payments for interest in fiscal 2005 decreased as compared

to fiscal 2004 primarily due to lower debt levels and the timing of

interest payments made related to the senior notes. The decrease

in income taxes paid from fiscal 2004 to fiscal 2005 is primarily due

to lower current taxable income as well as the benefit of some

overpayments carried over from fiscal 2004. The increase in income

taxes paid from fiscal 2003 to fiscal 2004 is primarily due to a

refund received in fiscal 2003.

TRANSACTIONS WITH RELATED PARTIES

>> 16

The Company has operating leases for farms, equipment and other

facilities with Don Tyson, a director of the Company, certain members

of his family and the Randal W. Tyson Testamentary Trust. Total

payments of $8 million in fiscal years 2005, 2004 and 2003 were

paid to entities in which these parties had an ownership interest.

Additionally, other facilities have been leased from other officers

and directors. Rentals paid to entities in which these parties had

an ownership interest totaled $1 million in fiscal years 2005 and

2004, and $2 million in fiscal 2003.

In the fourth quarter of fiscal 2005, the company purchased a

parcel of land adjacent to the Company’s Corporate Center for

approximately $600,000 from JHT, LLC, a limited liability company

of which Don Tyson, a director of the Company, and the Randal W.

Tyson Testamentary Trust, are members. The land is to be used for

expansion of corporate offices.

In the fourth quarter of fiscal 2005, the Company received approxi-

mately $4 million from entities owned by Don Tyson, a director

of the Company, and John Tyson, Chairman and CEO of the

Company, as payment for the purchase of certain properties

owned by the Company.

In the third quarter of fiscal 2004, the Company purchased a

parcel of land adjacent to the Company’s Corporate Center for

approximately $356,000 from JHT, LLC, a limited liability company

of which Don Tyson, a director of the Company, and the Randal W.

Tyson Testamentary Trust are members. The land is to be used for

expansion of corporate offices.

In the second quarter of fiscal 2004, the Company purchased

1,028,577 shares of Class A stock in a private transaction with

Don Tyson, a director and managing partner of the Tyson Limited

Partnership, a principal shareholder of the Company. The purchase

of those shares from Mr. Tyson, was based on the closing price

of the Class A stock on the New York Stock Exchange on the

date of purchase.

During fiscal 2004, the Company received cash payments from

Don Tyson, a director of the Company, totaling $1.5 million, as

reimbursement for certain perquisites and personal benefits

received during fiscal years 1997 through 2003.

Certain officers and directors were engaged in chicken and swine

growout operations with the Company whereby these individuals

purchased animals, feed, housing and other items to raise the

animals to market weight. The total value of these transactions,

which were discontinued during fiscal 2003, amounted to

$11 million in fiscal 2003.

A former director who resigned from the Board of Directors during

2003, received $10 million in fiscal 2003 from the sale of cattle to a

subsidiary of the Company.