Tyson Foods 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> MANAGEMENT’S DISCUSSION AND ANALYSIS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

Tyson Foods, Inc. >> 24

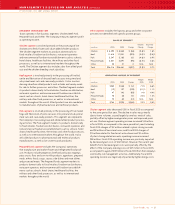

Pork segment sales increased 28.9% in fiscal 2004 as compared to

fiscal 2003. The increase in the Pork segment’s operating income

primarily was due to higher average sales prices and increased

demand, as pork benefited from stronger domestic and interna-

tional markets, more than offsetting increases in average live hog

prices. Operating income was negatively impacted by approxi-

mately $1 million related to fixed asset write-downs recorded in

fiscal 2004.

Prepared Foods segment sales increased 7.1% in fiscal 2004 as

compared to fiscal 2003. Fiscal 2004 operating income increased

$23 million, excluding plant closing costs of approximately

$27 million, intangible asset impairments of $22 million and fixed

asset write-downs of $5 million, all of which were recorded in

fiscal 2004. The increase in the Prepared Foods segment’s operating

income primarily was due to higher average sales prices and

increased volumes, partially offset by increased raw material prices.

Other segment operating income decreased $145 million primarily

due to settlements of $167 million received in fiscal 2003 in con-

nection with vitamin antitrust litigation. Additionally in fiscal 2003,

operating income was affected positively by actuarial gains of

$13 million resulting from certain retiree medical benefit plans.

ACQUISITION

In September 2003, the Company purchased Choctaw Maid Farms,

Inc. (Choctaw), an integrated poultry processor. Since 1992, Tyson

had been purchasing all of Choctaw’s production under a “cost

plus” supply agreement, which was scheduled to expire in 2007.

The Company previously had negotiated a purchase option with

Choctaw’s owners, which initially became exercisable in 2002.

The Company decided to exercise its purchase option rather than

continue under the “cost plus” arrangement of the supply agree-

ment. The acquisition was recorded as a purchase in accordance

with Statement of Financial Accounting Standards No. 141, “Business

Combinations” (SFAS No. 141). Accordingly, the assets and liabilities

were adjusted for fair values with the remainder of the purchase

price, $18 million, recorded as goodwill. The purchase price

consisted of $1 million cash to exercise the purchase option in

Tyson’s supply agreement with Choctaw and the settlement of

$85 million owed to Tyson by Choctaw. In addition, the Company

assumed approximately $4 million of Choctaw’s debt to a third

party. In June 2003, the Company exercised a $74 million purchase

option to acquire assets leased from a third party which the

Company had subleased to Choctaw. Pro forma operating results

reflecting the acquisition of Choctaw would not be materially

different from the Company’s actual results of operations.

LIQUIDITY AND CAPITAL RESOURCES

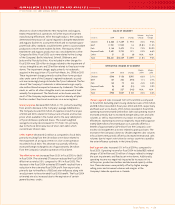

Cash provided by operations continues to be the Company’s

primary source of funds to finance operating requirements and

capital expenditures. In fiscal 2005, net cash of $999 million was

provided by operating activities, up $67 million from fiscal 2004.

The increase is primarily due to cash from working capital items of

$186 million in fiscal 2005, as compared to cash used by working

capital items of $47 million in fiscal 2004, partially offset by a

$132 million decrease in net income, excluding the non-cash effect

of deferred income taxes, as compared to the prior year. The posi-

tive working capital for fiscal 2005 is primarily due to an increase

in income taxes payable resulting primarily from timing of pay-

ments of federal and state estimated payments and improvements

in the cash cycle around accounts receivable, accounts payable

and inventory. The Company used cash, primarily from operations,

to reduce debt by $367 million, to fund $571 million of property,

plant and equipment additions, to pay dividends of $55 million and

to repurchase $45 million of the Company’s Class A common stock

in the open market. The Company’s foreseeable cash needs for

operations growth and capital expenditures are expected to con-

tinue to be met through cash flows provided by operating activities.

Additionally, at October 1, 2005, the Company had borrowing

capacity of $1.5 billion consisting of $746 million available under

its $1.0 billion unsecured revolving credit facility and $750 million

under its accounts receivable securitization. At October 1, 2005,

the Company had construction projects in progress that will

require approximately $521 million to complete. Capital spending

for fiscal 2006 is expected to be in the range of $600 million to

$650 million.

$999

$932

$820

CASH PROVIDED

BY OPERATING

ACTIVITIES

IN MILLIONS

2003 2004 2005