Tyson Foods 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> MANAGEMENT’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2005 ANNUAL REPORT

>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>

Tyson Foods, Inc. >> 19

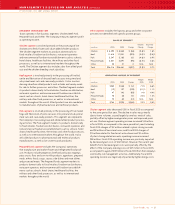

RESULTS OF OPERATIONS

OVERVIEW

Tyson Foods is the world’s largest protein company and the second

largest publicly traded food company in the Fortune 500 with one

of the most recognized brand names in the food industry. Tyson

produces, distributes and markets chicken, beef, pork and prepared

foods and related allied products. The Company’s primary operations

are conducted in four segments: Chicken, Beef, Pork and Prepared

Foods. Some of the key factors that influence the Company’s busi-

ness are customer demand for the Company’s products, the ability

to maintain and grow relationships with customers and introduce

new and innovative products to the marketplace, accessibility of

international markets, market prices for the Company’s chicken,

beef and pork products, the cost of live cattle and hogs, raw mate-

rials and grain and operating efficiencies of the Company’s facilities.

Earnings for fiscal 2005 were $353 million, or $0.99 per diluted share,

compared to $403 million, or $1.13 per diluted share, in fiscal 2004.

Pretax earnings for fiscal 2005 included $33 million of costs related

to a legal settlement involving the Company’s live swine opera-

tions, $14 million of costs for plant closings, $8 million of losses

related to Hurricane Katrina, $12 million received in connection

with vitamin antitrust litigation and a gain of $8 million from the

sale of the Company’s remaining interest in Specialty Brands, Inc.

Additionally, earnings included a non-recurring income tax net

benefit of $15 million. The net benefit includes the reversal of tax

reserves, partially offset by an income tax charge related to the

repatriation of foreign income. Combined, these items decreased

fiscal 2005 diluted earnings per share by $0.02. Pretax earnings

for fiscal 2004 included $40 million of costs for plant closings,

$61 million of BSE-related charges and $46 million of fixed asset

write-downs and intangible asset impairments. Combined, these

items decreased fiscal 2004 diluted earnings per share by $0.26.

Operations for fiscal 2005 benefited from higher average sales prices

in the Company’s Chicken, Pork and Prepared Food segments, prod-

uct mix improvements and decreased grain costs in the Company’s

Chicken segment. These benefits were partially offset by losses

from the Company’s commodity risk management activities related

to grain purchases as compared to prior year gains from commodity

risk management activities on grain positions. Operating income

was also negatively impacted by higher energy costs, higher live

hog prices in the Pork segment and higher raw material costs in the

Prepared Foods segment. Additionally, earnings for fiscal 2005 were

negatively impacted by the Company’s Beef segment operating loss,

primarily due to lower domestic cattle supplies and restrictions on

imports of Canadian cattle for most of the year, which resulted in

lower production volumes and raised the operating cost per head.

Also, the Beef segment’s operating results were negatively impacted

by limited access to export markets.

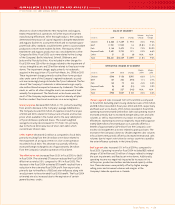

In fiscal 2005, the Company continued to generate strong cash

flow. This allowed the Company to pay down debt by $367 million,

and exceed the Company’s debt-to-capital ratio goal of 40% by

reaching 39% at year end. The Company began construction of a

third fully dedicated case-ready plant in fiscal 2005. This plant is

scheduled to begin operating in fiscal 2006, and once fully opera-

tional, it is expected to increase case-ready capacity by one-third.

Additionally, in fiscal 2005, the Company continued construction

of facilities at its Corporate Center, as well as a variety of other

projects that will increase automation and support value-added

product growth.

The Company’s accounting cycle resulted in a 52-week year for

fiscal years 2005 and 2003, and a 53-week year for fiscal 2004.

OUTLOOK

As the Company begins fiscal 2006, its intent is to continue to

focus on the three primary elements of the Company’s strategy.

The first element of the strategy is to continue to increase the sales

mix of value-added products. The Company’s goal for fiscal 2006

is to increase its mix of value-added product sales to $12 billion, an

increase of approximately $900 million as compared to fiscal 2005.

The second element of the strategy is to continue to improve oper-

ating efficiencies. For fiscal 2006, the Company anticipates spending

approximately $232 million on cost savings and income producing

projects, which are expected to result in annual after tax savings

of approximately $72 million. The third element of the strategy

is to expand the Company’s presence in international markets.

The Company’s goal for fiscal 2006 is to increase its in-country

presence in at least one foreign market.

In fiscal 2006, the Company expects the Chicken segment results

to remain solid. Currently, grain prices are expected to be favorable

in fiscal 2006 as compared to fiscal 2005, and the Company antici-

pates good demand for chicken going into the start of fiscal 2006.

The Company anticipates operating income will be negatively

impacted in fiscal 2006 by higher energy costs. Although there

have been recent developments in the beef export market that

are encouraging, the Company believes the Beef segment will

continue to face difficult operating conditions in fiscal 2006,

especially in the first two quarters of the year. The Company

anticipates the supply of live hogs to increase slightly in fiscal 2006,

which should generate more normal returns in the Pork segment.

Additionally, the Company anticipates improved market share in

the Prepared Foods segment in fiscal 2006.