Tyson Foods 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> MANAGEMENT’S DISCUSSION AND ANALYSIS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

Tyson Foods, Inc. >> 28

Contingent liabilities: The Company is subject to lawsuits, investiga-

tions and other claims related to wage and hour/labor, livestock

procurement, securities, environmental, product, taxing authorities

and other matters, and is required to assess the likelihood of any

adverse judgments or outcomes to these matters, as well as poten-

tial ranges of probable losses. A determination of the amount of

reserves and disclosures required, if any, for these contingencies are

made after considerable analysis of each individual issue. These

reserves may change in the future due to changes in the Company’s

assumptions, the effectiveness of strategies or other factors

beyond the Company’s control.

Accrued self insurance: Insurance expense for health and welfare,

workers’ compensation, auto liability and general liability risks

are estimated using historical experience and actuarial estimates.

The assumptions used to arrive at periodic expenses are reviewed

regularly by management. However, actual expenses could differ

from these estimates, which could result in adjustments to

amounts recorded.

Impairment of long-lived assets: The Company is required to assess

potential impairments to its long-lived assets, which are primarily

property, plant and equipment. If impairment indicators are pres-

ent, the Company must measure the fair value of the assets in

accordance with Statement of Financial Accounting Standards

No. 144, “Accounting for the Impairment of Disposal of Long-Lived

Assets,” to determine if adjustments are to be recorded.

Goodwill and other intangible asset impairment: In assessing the

recoverability of the Company’s goodwill and other intangible

assets, management must make assumptions regarding estimated

future cash flows and other factors to determine the fair value of

the respective assets. If these estimates and related assumptions

change in the future, the Company may be required to record

impairment charges not previously recorded. The Company assesses

its goodwill and other intangible assets for impairment at least

annually in accordance with Statement of Financial Accounting

Standards No. 142, “Goodwill and Other Intangible Assets.”

Marketing and advertising costs: The Company incurs advertising,

retailer incentive and consumer incentive costs to promote its

products through its marketing programs. These programs include

cooperative advertising, volume discounts, in-store display incen-

tives, coupons and other programs. The recognition of the costs

related to these programs requires management judgment in

estimating the potential performance and redemption of each

program. These estimates are based on many factors, including

historical experience of similar promotional programs. Actual

expenses may differ if the performance and redemption rates

vary from the estimated rates.

Income taxes: The Company estimates its total income tax expense

based on statutory tax rates and tax planning opportunities avail-

able to the Company in various jurisdictions in which the Company

earns income. Federal income taxes include an estimate for taxes

on earnings of foreign subsidiaries that are expected to be remitted

to the United States and be taxable, but not for earnings that are

considered permanently invested in the foreign subsidiary. Deferred

income taxes are recognized for the future tax effects of temporary

differences between financial and income tax reporting using tax

rates in effect for the years in which the differences are expected

to reverse. Valuation allowances are recorded when it is more

likely than not that a tax benefit will not be realized for a

deferred tax asset.

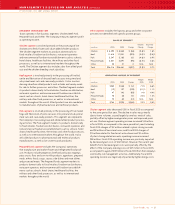

NON-GAAP FINANCIAL MEASURES

This report and other public communications issued by the

Company from time to time include certain non-GAAP (Generally

Accepted Accounting Principles) financial measures, which are

defined as numerical measures of a company’s financial perfor-

mance, financial position or cash flows that exclude (or include)

amounts that are included in (or excluded from) the most directly

comparable measures calculated and presented in accordance

with GAAP in the Company’s financial statements.

Non-GAAP financial measures utilized by the Company include

presentations of operating income and other GAAP measures of

operating performance that exclude or include the effect of the

closings of selected operations, BSE-related charges, dispositions

of assets or investments, fixed asset write-downs, impairment

charges related to various intangible assets, litigation settlements,

natural disaster related charges, non-recurring income tax adjust-

ments and other similar events. The Company’s management

believes these non-GAAP financial measures provide useful infor-

mation to investors by removing the effect of variances in GAAP

reported results of operations that are not indicative of fundamen-

tal changes in the Company’s earnings. Management also believes

the presentation of these non-GAAP financial measures is consis-

tent with its past practice, as well as industry practice in general,

and will enable investors and analysts to compare current

non-GAAP measures with non-GAAP measures presented in prior

periods. The non-GAAP financial measures used by the Company

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP.