Tyson Foods 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>> NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

TYSON FOODS, INC. 2005 ANNUAL REPORT

Tyson Foods, Inc. >> 42

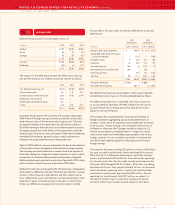

In the first quarter of fiscal 2003, the Company recorded

$47 million of costs related to the closing of its Stilwell, Oklahoma,

and Jacksonville, Florida, plants that included $26 million of costs

related to closing the plants and $21 million of estimated impair-

ment charges for assets to be disposed. The costs related to closing

the plants include $17 million for estimated liabilities for the resolu-

tion of the Company’s obligations under grower contracts, and

$9 million of other related costs associated with closing the plants,

including plant clean-up costs and employee termination benefits.

The Company accounted for closing the Stilwell, Oklahoma, and

Jacksonville, Florida, operations in accordance with Emerging Issues

Task Force No. 94-3, “Liability Recognition for Certain Employee

Termination Benefits and Other Costs to Exit an Activity” (EITF 94-3)

and SFAS No. 144. The costs were reflected in the Chicken segment

as a reduction of operating income and included in the Consolidated

Statements of Income in other charges. The Company recorded

a $4 million increase to the original accrual during fiscal 2004. A

$1 million decrease to the original accrual was recorded in fiscal 2005.

At October 1, 2005, the Company had fully paid its obligations under

grower contracts of $16 million and other closing costs of $13 million

had been paid.

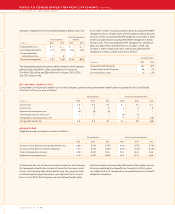

BSE-RELATED CHARGES

>> 04

On December 23, 2003, the U.S. Department of Agriculture

(USDA) announced a single case of BSE had been diagnosed in a

Washington State dairy cow. The effect on the Company’s Beef

segment caused by that announcement, along with the decision of

various countries to restrict imports of U.S. beef products, resulted

in the Company recording BSE-related pretax charges of approxi-

mately $61 million in fiscal 2004. These charges were included in

cost of sales and primarily related to the decline in value of

finished product inventory destined for international markets,

whether in-transit, located at the shipping ports or located within

domestic storage, as well as live cattle inventory and open futures

positions. No material adjustments were made subsequent to the

initial BSE-related accruals recorded in first quarter of fiscal 2004.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

>> 05

At October 1, 2005, and October 2, 2004, the allowance for doubt-

ful accounts was $9 million and $11 million, respectively.

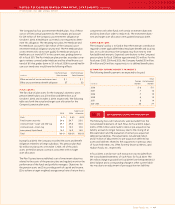

FINANCIAL INSTRUMENTS

>> 06

The Company purchases certain commodities, such as corn, soybeans,

livestock and natural gas, in the course of normal operations. As

part of the Company’s commodity risk management activities, the

Company uses derivative financial instruments, primarily futures

and swaps, to reduce its exposure to various market risks related to

these purchases. Generally, contract terms of a financial instrument

qualifying as a hedge instrument closely mirror those of the hedged

item, providing a high degree of risk reduction and correlation.

Contracts that are designated and highly effective at meeting the

risk reduction and correlation criteria are recorded using hedge

accounting, as defined by Statement of Financial Accounting

Standards No. 133, “Accounting for Derivative Instruments and

Hedging Activities” (SFAS No. 133), as amended. If a derivative

instrument is a hedge, as defined by SFAS No. 133, changes in the

fair value of the instrument will be either offset against the change

in fair value of the hedged assets, liabilities or firm commitments

through earnings or recognized in other comprehensive income (loss)

until the hedged item is recognized in earnings. The ineffective

portion of an instrument’s change in fair value will be immediately

recognized in earnings as a component of cost of sales.

The Company had derivative related balances of $117 million and

$87 million recorded in other current assets at October 1, 2005,

and October 2, 2004, respectively, and $125 million and

$83 million in other current liabilities at October 1, 2005,

and October 2, 2004, respectively.

Cash flow hedges: The Company uses derivatives to moderate the

financial and commodity market risks of its business operations.

Derivative products, such as futures and option contracts, are

considered to be a hedge against changes in the amount of future

cash flows related to commodities procurement. The Company

also enters into interest rate swap agreements to adjust the pro-

portion of total long-term debt and leveraged equipment loans

subject to variable interest rates. Under these interest rate swaps,

the Company agrees to pay a fixed rate of interest times a notional

principal amount and to receive in return an amount equal to a

specified variable rate of interest times the same notional principal

amount. These interest rate swaps are considered to be a hedge

against changes in the amount of future cash flows associated

with the Company’s variable rate interest payments.

The effective portion of the cumulative gain or loss on the deriva-

tive instrument is reported as a component of other comprehensive

income (loss) in shareholders’ equity and recognized into earnings

in the same period or periods during which the hedged transaction