TripAdvisor 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

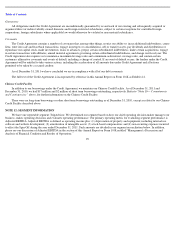

a $19 million payable, respectively. In addition to the revenue and expense relationships described above, the change in the payable/receivable

balance was also affected by our transfer of domestic cash receipts to Expedia during the periods offset by Expedia’s funding of our payroll and

income tax payments as well as certain acquisitions. In connection with the Spin-Off, all domestic intercompany receivables/payables with

Expedia were extinguished.

As discussed in “Note 1— Organization and Basis of Presentation ” above, we transferred approximately $406 million in cash to Expedia

in the form of a dividend, prior to completion of the Spin-Off. Per the Separation Agreement we were to retain $165 million in cash on hand

immediately following the Spin-off and the agreement also provides for a subsequent reconciliation process to ensure the appropriate amount

was retained. The completion of this reconciliation resulted in us recording an additional receivable from Expedia of $7 million at December 31,

2011.

We were a guarantor of Expedia’s credit facility and outstanding senior notes. These guarantees were full, unconditional, joint and several,

and were released upon Spin-Off.

Relationship Between Expedia and TripAdvisor After the Spin

-Off

For purposes of governing certain of the ongoing relationships between us and Expedia at and after the Spin-Off, and to provide for an

orderly transition, we and Expedia have entered into various agreements, including, among others, the Separation Agreement; the Tax Sharing

Agreement, the Employee Matters agreement, the Transition Services Agreement, and commercial agreements, which are discussed in the

section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The various commercial

agreements, including click-based advertising agreements, content sharing agreements and display-based and other advertising agreements, have

terms of up to one year.

The full texts of the Separation Agreement, the Tax Sharing Agreement, the Employee Matters Agreement, the Transition Services

Agreement and the Master Advertising Agreement (CPC) are incorporated by reference on this Annual Report on Form 10-K as Exhibits 2.1,

10.2, 10.3, 10.4 and 10.6 (10.6 filed in redacted form pursuant to confidential treatment request), respectively.

Liberty and Barry Diller

Relationship Between Liberty and Barry Diller After the Spin

-Off

On December 20, 2011, in connection with the Spin-Off, we entered into a governance agreement (the “Governance Agreement”) with

Liberty Interactive Corporation (“Liberty”) and Barry Diller, the Chairman of our Board of Directors and our Senior Executive. The summary of

the material terms of the Governance Agreement are discussed above in the section entitled “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and are qualified in their entirety by the full text of the Governance Agreement, which is

incorporated by reference on this Annual Report on Form 10-K as Exhibit 10.1. On December 20, 2011, in connection with the Spin-

Off, Liberty

and Mr. Diller also entered into a stockholders agreement.

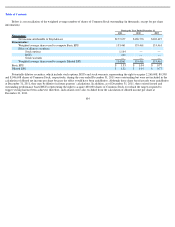

Liberty and Mr. Diller beneficially own 28,510,177 shares of our Common Stock (assuming the exercise of options to purchase

2,000,000 shares of Common Stock and 19,530 shares of Common Stock issuable upon settlement of RSUs that become exercisable by

Mr. Diller or vest within 60 days of December 30, 2011) and 12,799,999 shares of Class B Common Stock, which shares constitute 23.2% of the

outstanding shares of Common Stock and 100% of the outstanding shares of Class B Common Stock.

Assuming the conversion of all of the Liberty and Barry Diller’s shares of Class B Common Stock into Common Stock, Liberty and

Mr. Diller would beneficially own 30.5% of the outstanding Common Stock (calculated in accordance with Rule 13d-3). Because each share of

Class B Common Stock generally is entitled to ten votes per share and each share of Common Stock is entitled to one vote per share Liberty and

Mr. Diller may be deemed to beneficially own equity securities representing approximately 62.4% of our voting power.

95