TripAdvisor 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Certain of our subsidiaries that operate in China, have variable interests in affiliated entities in China in order to comply with Chinese laws

and regulations, which restrict foreign investment in Internet content provision businesses. Although we do not own the capital stock of some of

our Chinese affiliates, we consolidate their results as we are the primary beneficiary of the cash losses or profits of these variable interest

affiliates and have the power to direct the activities of these affiliates. Our variable interest entities are not material for all periods presented.

Accounting Estimates

We use estimates and assumptions in the preparation of our consolidated and combined financial statements in accordance with GAAP.

Our estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the

date of our consolidated and combined financial statements. These estimates and assumptions also affect the reported amount of net income or

loss during any period. Our actual financial results could differ significantly from these estimates. The significant estimates underlying our

consolidated and combined financial statements include revenue recognition; recoverability of long-lived assets, intangible assets and goodwill;

income taxes; useful lives of property and equipment; purchase accounting and stock-based compensation.

Reclassifications

Certain reclassifications have been made to conform the prior period’s data to the current format.

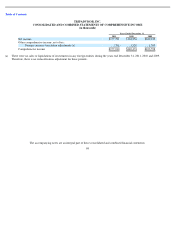

Our management has changed the non-

GAAP financial measure that we use to measure our operating performance from Operating Income

Before Amortization (“OIBA”) to Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (“Adjusted EBITDA”).

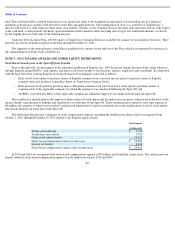

Consequently we have reclassified all our depreciation expense, which previously had resided in technology and content expense and general

and administrative expense, and have presented it as a separate line item on the consolidated and combined statement of operations. This

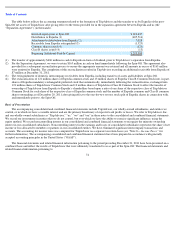

reclassification had no net effect on either total operating expenses or total operating income for any period. The table below provides a

summary of that reclassification for the periods presented.

Revenue Recognition

We recognize revenue from the advertising services rendered when the following four revenue recognition criteria are met: persuasive

evidence of an arrangement exists, services have been rendered, the price is fixed or determinable, and collectability is reasonably assured.

Click-based Advertising . Revenue is derived primarily from click-through fees charged to our travel partners for traveler leads sent to the

travel partners’ website. We record revenue from click-through fees after the traveler makes the click-through to the travel partners’ websites.

76

Year ended December 31,

(in thousands)

2010

2009

Depreciation (1)

$

12,871

$

9,330

Technology and content

(10,351

)

(7,743

)

General and administrative

(2,520

)

(1,587

)

$

—

$

—

(1) Total depreciation expense as reported on our Registration Statement on Form S-4, filed with the SEC on November 1, 2011 (the

“

Registration Statement

”

),

in our consolidated and combined statement of cash flows.