TripAdvisor 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

TRIPADVISOR, INC.

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

NOTE 1: ORGANIZATION AND BASIS OF PRESENTATION

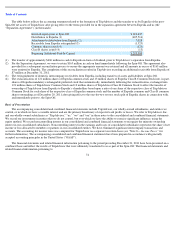

On April 7, 2011, Expedia, Inc. (“Expedia”) announced its plan to separate into two independent public companies in order to better

achieve certain strategic objectives of its various businesses. We refer to this transaction as the “Spin-Off.” Non-recurring expenses incurred to

affect the Spin-Off during the year ended December 31, 2011 have been included within Spin-Off costs in the consolidated and combined

statements of operations.

In connection with the Spin-Off, we were incorporated as a Delaware corporation in July 2011. On November 1, 2011, the Securities and

Exchange Commission (“SEC”) declared the Form S-4 with information pertaining to the Spin-Off, which included a preliminary proxy

statement for Expedia and prospectus for Expedia and TripAdvisor, as effective. On December 6, 2011, at Expedia’s annual meeting of

stockholders, Expedia’s stockholders approved the Spin-Off, and the related proposals submitted. The Spin-Off was also approved by Expedia’s

Board of Directors on December 6, 2011. Also in December 2011 Expedia received a favorable private letter ruling from the Internal Revenue

Service (“IRS”) on the tax-free nature of the Spin-Off.

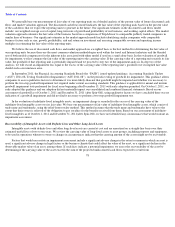

On December 20, 2011, following the close of trading on the NASDAQ Global Select Market (“NASDAQ”), the Spin-Off was completed,

and TripAdvisor began trading as independent public company on December 21, 2011. Expedia effected the Spin-Off by means of a

reclassification of its capital stock that resulted in the holders of Expedia capital stock immediately prior to the time of effectiveness of the

reclassification having the right to receive a proportionate amount of TripAdvisor capital stock. A one-for-two reverse stock split of outstanding

Expedia capital stock occurred immediately prior to the Spin-Off, with cash paid in lieu of fractional shares.

In connection with the Spin-Off, Expedia contributed or transferred all of the subsidiaries and assets relating to Expedia’s TripAdvisor

Media Group, which are comprised of the TripAdvisor Holdings, LLC combined financial statements, to TripAdvisor and TripAdvisor or one of

its subsidiaries assumed all of the liabilities relating to Expedia’

s TripAdvisor Media Group. TripAdvisor now trades on the NASDAQ under the

symbol “TRIP.”

In connection with the Spin-Off, on December 20, 2011, TripAdvisor Holdings, LLC distributed approximately $406 million in cash to

Expedia in the form of a dividend. This distribution was funded through borrowings under a new credit agreement, dated as of December 20,

2011, among TripAdvisor, TripAdvisor Holdings, LLC, TripAdvisor LLC, the lenders party thereto, JPMorgan Chase Bank, N.A., as

administrative agent, and J.P. Morgan Europe Limited, as London agent. Such credit agreement together with all exhibits, schedules, annexes,

certificates, assignments and related documents contemplated thereby is referred to herein as the “Credit Agreement.” The Credit Agreement

provides for a five-year term loan (the “Term Loan,”) to TripAdvisor Holdings, LLC in a principal amount of $400 million, repayable in

quarterly installments equal to 1.25% of the original principal amount in year 2012 and 2.5% of the original principal amount in each year

thereafter, with the balance payable on the final maturity date. The Credit Agreement also provides for a revolving credit facility (the “

Revolving

Credit Facility”) with a maximum borrowing capacity of $200 million. On December 20, 2011, TripAdvisor Holdings, LLC borrowed $10

million under the Revolving Credit Facility. All outstanding principal and interest under the Term Loan and the Revolving Credit Facility will be

due and payable, and the Revolving Credit Facility will terminate, on December 20, 2016. The obligations of each borrower under the Credit

Agreement are the senior unsecured obligations of such borrower and are guaranteed by TripAdvisor (following consummation of the Spin-

Off),

TripAdvisor Holdings, LLC, and certain of their respective subsidiaries. Refer to “Note 11— Debt ” and our debt discussion in the section

entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Position, Liquidity and Capital

Resources” above for further information.

73