TripAdvisor 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The aggregate intrinsic value of outstanding options shown in the stock option activity table above represents the total pretax intrinsic

value at December 31, 2011, based on TripAdvisor’s closing stock price of $25.21 as of the last trading date.

During 2011, we did not grant any stock options under the 2011 Incentive Plan .

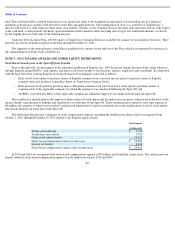

RSUs are stock awards that are granted to employees entitling the holder to shares of TripAdvisor’s Common Stock as the award vests.

Our RSUs issued upon Spin-Off generally vest over five years, but may accelerate in certain circumstances, including certain changes in control

of TripAdvisor.

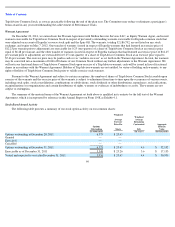

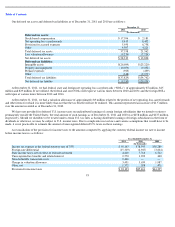

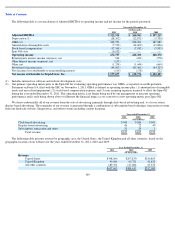

The following table presents a summary of RSU activity on our common shares:

In the year ended December 31, 2011, we issued 32,526 RSUs under the 2011 Incentive Plan, to our non-employee members of the Board

of Directors, which we measured their fair value based on the quoted price of our Common Stock at the date of grant (which was December 21,

2011). We will amortize the fair value, net of estimated forfeitures, as stock-based compensation expense over the vesting term of three years on

a straight-line basis.

Included in RSUs outstanding at December 31, 2011 are 400,000 RSUs awarded to our one of our non-employee Board of Directors, for

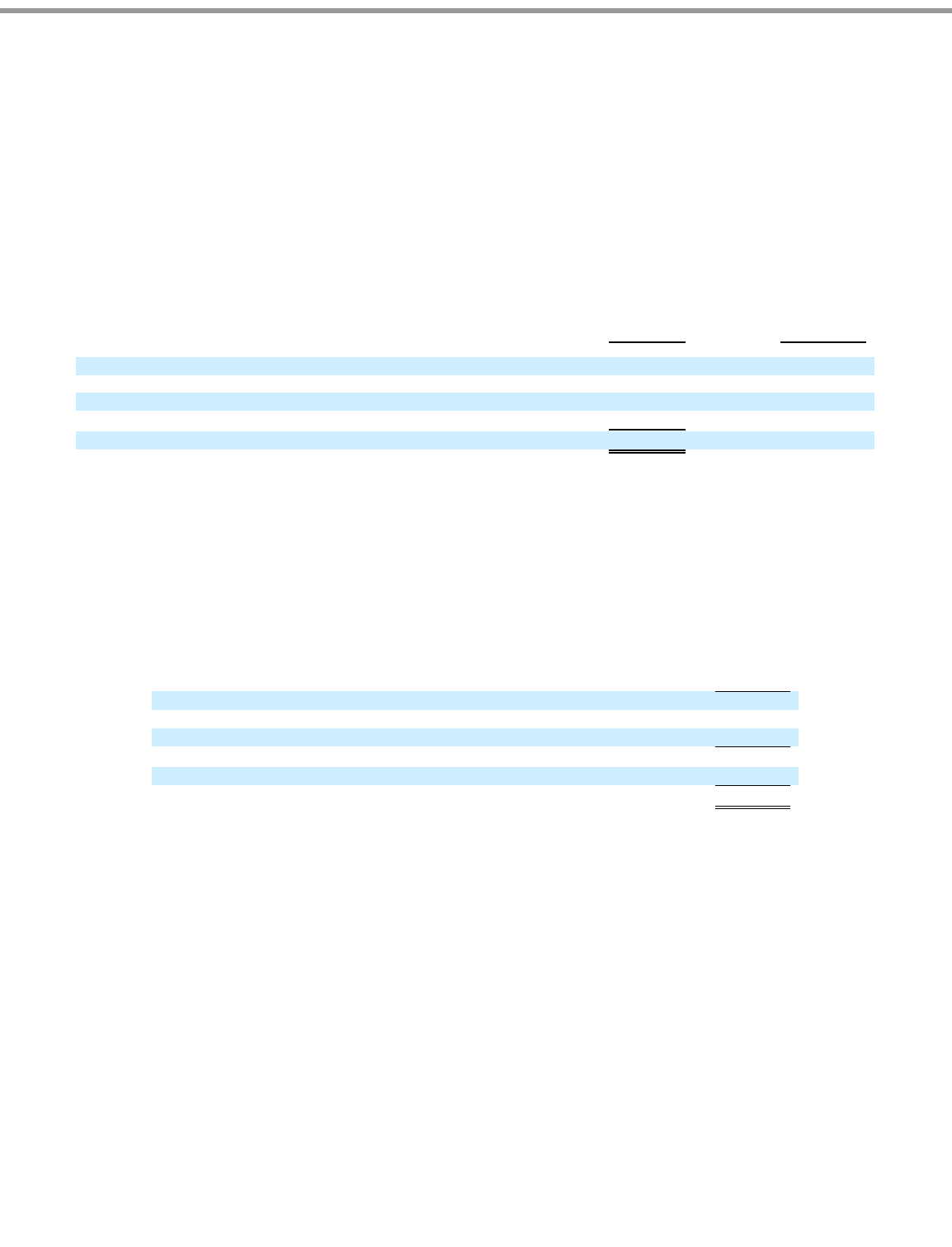

which vesting is tied to achievement of performance targets and a requisite service period. The following table presents a summary of stock

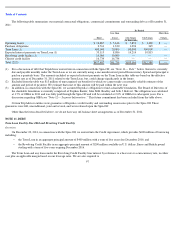

compensation expense from December 21, 2011 though the year ended December 31, 2011:

As of December 31, 2011, we had 32,186,792 million fully vested stock warrants outstanding, which are exercisable for 8,046,698

common shares with expiration dates through May 2012 and a weighted average exercise price of $27.09.

As of December 31, 2011, there was approximately $28 million of unrecognized stock-based compensation expense, net of estimated

forfeitures, related to unvested stock-based awards, which is expected to be recognized in expense over a weighted-average remaining period of

2.8 years.

91

RSUs

Outstanding

Weighted

Average

Grant-

Date Fair

Value Per Share

(In thousands)

Unvested RSUs outstanding as of December 20, 2011

893

$

21.09

Granted

33

27.67

Vested and released

—

—

Cancelled

—

—

Unvested RSUs outstanding as of December 31, 2011

926

$

21.32

Total Expense

(in

thousands)

Selling and marketing

$

112

Technology and content

148

General and administrative

184

Stock

-

based compensation before income taxes

$

444

Income tax benefit

166

Stock

-

based compensation expense after income taxes

$

278