TripAdvisor 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

amendments in this update are effective for annual and interim goodwill impairment tests performed for fiscal years beginning after

December 15, 2011. Early adoption is permitted, and we adopted ASU 2011-

08 on October 1, 2011 for the fiscal year 2011 goodwill impairment

test. The adoption of ASU 2011-08 did not have a material impact our consolidated and combined financial statements.

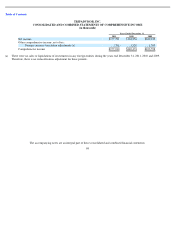

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220): Presentation on Comprehensive Income , or ASU

2011-05. Under ASU 2011-05, there will no longer be the option to present items of other comprehensive income in the statement of

stockholders’ equity. ASU 2011-05 requires entities to present net income and other comprehensive income in either a single continuous

statement or in two separate, but consecutive, statements of net income and other comprehensive income. ASU 2011-05 is effective for fiscal

years and interim periods beginning after December 15, 2011 on a retrospective basis, with early adoption permitted. Accordingly, we have

adopted the presentation requirements of ASU 2011-05. The adoption of ASU 2011-05 did not have a material impact on our consolidated and

combined financial statements.

Market Risk Management

We are exposed to certain market risks, including changes in interest rates and foreign currency exchange rates that could adversely affect

our results of operations or financial condition. We manage our exposure to these risks through established policies and procedures and by

assessing the anticipated near-term and long-term fluctuations in interest rates and foreign currency exchange rates. Our objective is to mitigate

potential income statement, cash flow and market exposures from changes in interest and foreign exchange rates.

Interest Rates

We have historically invested excess cash balances primarily in cash deposits, money market investments and time deposits held at major

banks, accordingly, we are exposed to market risk related to changes in interest rates. The Spin-

Off has had a material impact on our interest rate

risk due to newly issued variable rate debt. As of December 31, 2011, we had $400 million of debt under our Term Loan, which has a variable

rate. The variable interest rate on the Term Loan is based on current assumptions, leverage and LIBOR rates. Based on our current loan balance

through December 31, 2011, a 25 basis point change in our interest rate on the Term Loan would result in an increase or decrease to interest

expense of approximately $1 million per annum. We currently do not hedge our interest rate risk; however, if we become increasingly exposed

to potentially volatile movements in interest rates, and if these movements are material, this could cause us to adjust our financing strategy.

Foreign Currency Exchange Rates

We conduct business in certain international markets, primarily the European Union, the U.K. and China. Because we operate in

international markets, we have exposure to different economic climates, political arenas, tax systems and regulations that could affect foreign

exchange rates. Our primary exposure to foreign currency risk relates to transacting in foreign currency and recording the activity in U.S. dollars.

Changes in exchange rates between the U.S. dollar, the British pound sterling, the Euro and other currencies will result in transaction gains or

losses, which we recognize in our consolidated and combined statements of operations. As we increase our operations in international markets,

we become increasingly exposed to potentially volatile movements in currency exchange rates. These movements, if material, could cause us to

adjust our financing and operating strategies.

Currency exchange rates change and translation of statements of operations of our international businesses into U.S. dollars affects year-

over-year comparability of operating results. Historically, we have not hedged translation risks because cash flows from international operations

were generally reinvested locally.

Foreign exchange gains and losses were not material for the years ended 2011, 2010 and 2009 and were included in other income

(expense) on our consolidated and combined statement of operations.

64

Item 7A.

Quantitative and Qualitative Disclosures About Market Risk