TripAdvisor 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

proceeds from the exercise of an award to repurchase Common Stock at the average market price for the period. Windfall tax benefits created

upon the exercise of an award would be added to assumed proceeds, while shortfalls charged to additional paid-in-capital would be deducted

from assumed proceeds. Any shortfalls not covered by the windfall tax pool would be charged to the income statement and would be excluded

from the calculation of assumed proceeds, if any.

The earnings per share amounts are the same for Common Stock and Class B Common Stock because the holders of each class are legally

entitled to equal per share distributions whether through dividends or in liquidation.

Recently Issued Accounting Pronouncements

In September 2011, the FASB issued ASU 2011-08. ASU 2011-08 was issued to amend FASB Accounting Standards Codification

(“ASC”) (Topic 350): Intangibles—Goodwill and Other. The guidance in ASU 2011-08 is intended to reduce complexity and costs by allowing

an entity the option to first make a qualitative evaluation about the likelihood of goodwill impairment to determine whether it should calculate

the fair value of a reporting unit. If entities determine, on the basis of qualitative factors, it is more likely than not that the fair value of a

reporting unit is less than the carrying amount, the two-step impairment test would be required. Otherwise, further testing would not be

needed. The amendments in this update are effective for annual and interim goodwill impairment tests performed for fiscal years beginning after

December 15, 2011. Early adoption is permitted, and we have adopted ASU 2011-08 on October 1, 2011 for the fiscal year 2011 goodwill

impairment test. The adoption of ASU 2011-08 did not have a material impact on our consolidated and combined financial statements.

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220): Presentation on Comprehensive Income (“ASU 2011-

05”). Under ASU 2011-05, there will no longer be the option to present items of other comprehensive income in the statement of stockholders’

equity. ASU 2011-05 requires entities to present net income and other comprehensive income in either a single continuous statement or in two

separate, but consecutive, statements of net income and other comprehensive income. ASU 2011-05 is effective for fiscal years and interim

periods beginning after December 15, 2011 on a retrospective basis, with early adoption permitted. Accordingly, we have adopted the

presentation requirements of ASU 2011-05. The adoption of ASU 2011-05 did not have a material impact on our consolidated and combined

financial statements.

NOTE 3: ACQUISITIONS

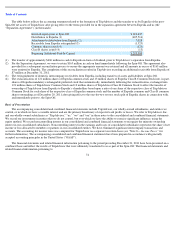

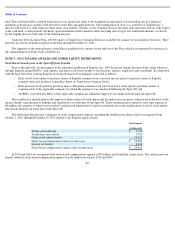

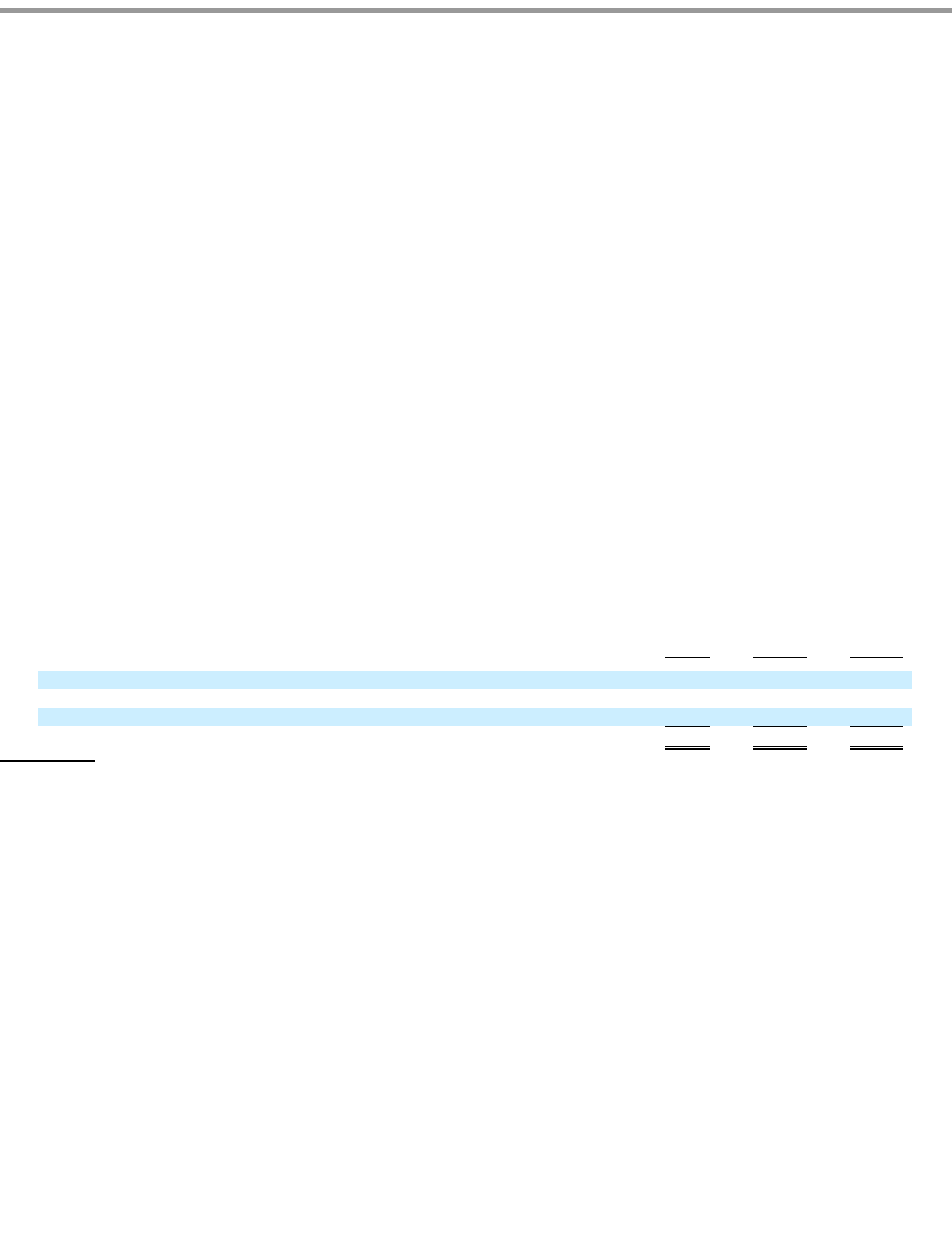

During 2011, 2010 and 2009, we acquired a number of companies including various online travel media content companies. The following

table summarizes the allocation of the purchase price for all acquisitions made in the years ended December 31, 2011, 2010 and 2009:

In addition, during 2011 and 2009, we paid $13 million and $8 million of contingent purchase consideration under prior acquisitions. The

amount in 2011 represented an earn-out payment, of which approximately $10

82

2011

2010

2009

(In thousands)

Goodwill

$

6,390

$

40,703

$

29,505

Intangible assets with definite lives (1)

1,642

8,148

9,000

Net liabilities and non

-

controlling interest acquired (2)

(16

)

(3,580

)

(18

)

Total (3)

$

8,016

$

45,271

$

38,487

(1)

The weighted average life of acquired intangible assets during 2011, 2010 and 2009 was 2.8 years, 6.2 years and 4.5 years, respectively.

(2)

Includes cash acquired of $0.1 million, $2 million and $2 million during 2011, 2010 and 2009, respectively.

(3)

All outstanding purchase contingencies have been paid as of December 31, 2011.