TripAdvisor 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

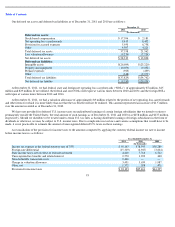

Table of Contents

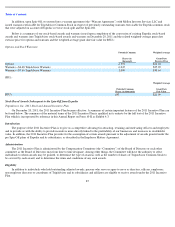

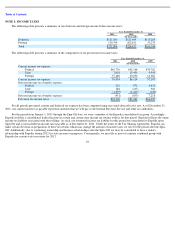

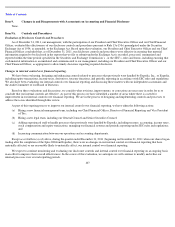

The following table summarizes our material contractual obligations, commercial commitments and outstanding debt as of December 31,

2011:

Certain TripAdvisor entities were guarantors of Expedia’s credit facility and outstanding senior notes prior to the Spin-Off. These

guarantees were full, unconditional, joint and several, and were released upon the Spin-Off.

Other than the items described above, we do not have any off-balance sheet arrangements as of December 31, 2011.

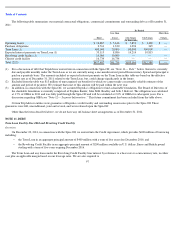

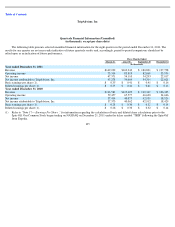

NOTE 11. DEBT

Term Loan Facility Due 2016 and Revolving Credit Facility

Overview

On December 20, 2011, in connection with the Spin-

Off, we entered into the Credit Agreement, which provides $600 million of borrowing

including:

The Term Loan and any loans under the Revolving Credit Facility bear interest by reference to a base rate or a eurocurrency rate, in either

case plus an applicable margin based on our leverage ratio. We are also required to

97

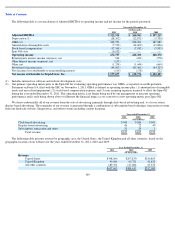

By Period

Total

Less than

1 year

1 to 3 years

3 to 5 years

More than

5 years

(In thousands)

Operating leases

$

14,887

$

5,616

$

7,851

$

1,420

$

—

Purchase obligations

2,761

1,320

1,096

345

—

Term Loan (1)

400,000

20,000

80,000

300,000

—

Expected interest payments on Term Loan (1)

33,115

8,086

14,214

10,815

Revolving credit facility (1)

10,000

10,000

—

—

—

Chinese credit facility

16,734

16,734

—

—

—

Total (2)(3)

$

477,497

$

61,756

$

103,161

$

312,580

$

—

(1)

For a discussion of debt that TripAdvisor entered into in connection with the Spin

-

Off, see

“

Note 11

—

Debt

”

below. Interest is currently

due and payable monthly under the Term Loan as we are currently using a one-month interest period Eurocurrency Spread and principal is

paid on a quarterly basis. The amounts included as expected interest payments on the Term Loan in this table are based on the effective

interest rate as of December 31, 2011 related to the Term Loan, but, could change significantly in the future.

(2) Excluded from the table was $13 million of unrecognized tax benefits for which we cannot make a reasonably reliable estimate of the

amount and period of payment. We estimate that none of this amount will be paid within the next year.

(3)

In addition, in connection with the Spin

-

Off, we assumed Expedia

’

s obligation to fund a charitable foundation. The Board of Directors of

the charitable foundation is currently comprised of Stephen Kaufer, Julie M.B. Bradley and Seth J. Kalvert. The obligation was calculated

at 1.7% of OIBA in 2011 and was fully paid through the Spin-Off and will be calculated at 2.0% of OIBA for subsequent years. For a

discussion regarding OIBA see

“

Note 12

—

Segment Information

.

”

This future commitment has been excluded from the table above.

•

the Term Loan in an aggregate principal amount of $400 million with a term of five years due December 2016; and

•

the Revolving Credit Facility in an aggregate principal amount of $200 million available in U.S. dollars, Euros and British pound

sterling with a term of five years expiring December 2016.