TripAdvisor 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

By virtue of previously filed consolidated income tax returns filed with Expedia, we are routinely under audit by federal, state and foreign

authorities. These audits include questioning the timing and the amount of income and deductions and the allocation of income among various

tax jurisdictions. Annual tax provisions include amounts considered sufficient to pay assessments that may result from the examination of prior

year returns. We are no longer subject to tax examinations by tax authorities for years prior to 2004.

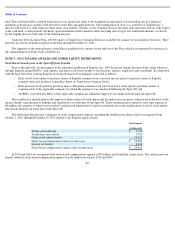

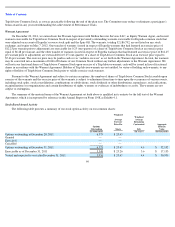

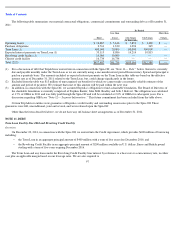

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits (excluding interest and penalties) is as follows:

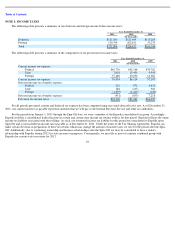

As of December 31, 2011, we had $13 million of unrecognized tax benefits, which is classified as long-term and included in other long-

term liabilities. Included in the balance at December 31, 2011 was $4 million of liabilities for uncertain tax positions that, if recognized, would

decrease our provision for income taxes. We recognize interest and penalties related to our liabilities for uncertain tax positions in the provision

for income taxes. During the years ended December 31, 2011, 2010 and 2009, we recognized less than $1 million of interest expense, net of

federal benefit and penalties, related to our liabilities for uncertain tax positions. We had less than $1 million accrued for the payment of interest

and penalties at December 31, 2011.

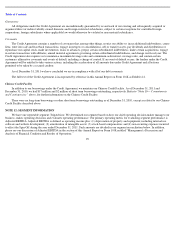

NOTE 9: RELATED PARTY TRANSACTIONS

Expedia

Relationship Between Expedia and TripAdvisor Prior to the Spin

-Off

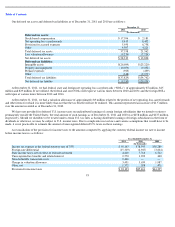

Related-party revenue from Expedia of $211 million, $171 million and $140 million for the years ended December 31, 2011, 2010 and

2009, respectively, primarily consists of click-based advertising and other advertising services provided to Expedia and its subsidiaries and is

recorded at contract value, which we believe is a reasonable reflection of the value of the services provided. Related-party revenue represented

33%, 35% and 40% of our total revenue for the years ended December 31, 2011, 2010 and 2009, respectively.

Prior to the Spin-Off, our operating expenses included a related-party shared services fee, which was comprised of allocations from

Expedia for accounting, legal, tax, corporate development, treasury and real estate functions and included an allocation of employee

compensation within these functions. These allocations were determined on a basis that Expedia and we considered to be a reasonable reflection

of the cost of services provided or the benefit received by us. These expenses were allocated based on a number of factors including headcount,

estimated time spent and operating expenses. It was not practicable to determine the amounts of these expenses that would have been incurred

had we operated as an unaffiliated entity. In the opinion of our management, the allocation method was reasonable.

Related party net interest income (expense) reflected in the consolidated and combined statements of operations is primarily intercompany

in nature, arising from the transfer of liquid funds between Expedia and us that occurred as part of Expedia’s treasury operations.

The net related party receivable and payable balances with Expedia and its subsidiaries reflected in our consolidated and combined balance

sheets as of December 31, 2011 and 2010 were a $14 million receivable and

94

2011

2010

2009

(In thousands)

Balance, beginning of year

$

6,342

$

2,672

$

2,456

Increases to tax positions related to the current year

5,631

3,913

—

Increases to tax positions related to the prior year

927

2,123

306

Reductions due to lapsed statute of limitations

—

(

2,366

)

—

Decreases to tax positions related to the prior year

—

—

(

90

)

Balance, end of year

$

12,900

$

6,342

$

2,672